|

Grieg Seafood ASA is one of the world’s leading salmon farmers, specializing in Atlantic salmon

Higher salmon harvest volume increases Grieg Seafood's earnings in Q3

NORWAY

NORWAY

Friday, November 08, 2019, 05:20 (GMT + 9)

Highlights

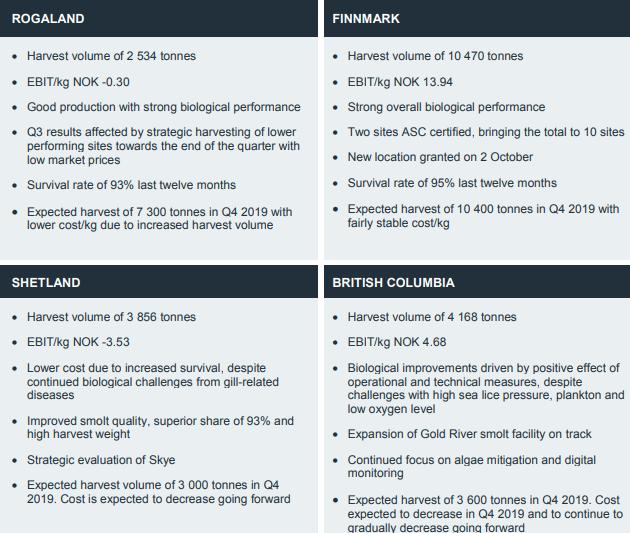

- Harvest volume of 21 000 tonnes (16 900 tonnes)

- EBIT/kg NOK 7.32, down 22% from Q3 2018

- Earnings impacted by lower spot market prices

- Strong biological performance in Norway and biological improvements in British Columbia

- Improved biological situation in Shetland resulted in lower cost

- Expected harvest volume of 82 000 tonnes in 2019, 10% growth from 2018

- 2020 harvest guiding of 100 000 tonnes remains

- Launch of GSF 2025 strategy, targeting cost leadership and harvest volume above 150 000 tonnes

- Dividend of NOK 2.00 per share

Financial results

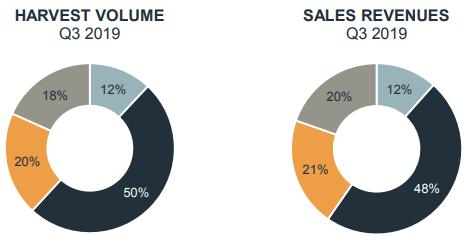

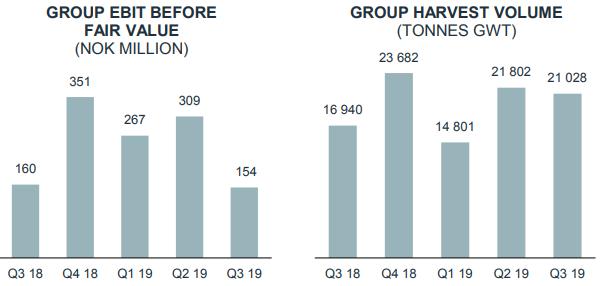

The Grieg Seafood Group harvested 21 028 tonnes GWT in Q3 2019, an increase of 24% compared to 16 941 tonnes in Q3 2018.

The average realized price was down in Q3 2019 compared to Q3 2018, mainly driven by lower average spot market prices. Revenues amounted to NOK 2 011 million, an increase of 27% compared to the same period last year, driven mainly by higher harvest volume.

Farming costs during the period (total cost related to fish harvested this quarter) remained stable compared to the same quarter last year.

The Group’s EBIT before fair value adjustment of biological assets was NOK 154 million (160) during the quarter, corresponding to an EBIT per kg of NOK 7.32 (9.43). EBIT from the four regions includes value creation from the respective sales activities of the Group’s jointly-owned sales company, Ocean Quality.

The Board is authorized by the Annual General Meeting to pay out additional dividends during 2019 based on the financial statements for 2018. Based on the financial position and the market outlook, the Board has decided to pay a dividend of NOK 2.00 per share.

Commenting on the Group’s performance, CEO Andreas Kvame, said:

.jpg) “The third quarter was yet again characterized by solid performance for our Norwegian operations, with strong biological performance and continued high survival rates. Our post-smolt strategy in Rogaland is developing well and in Finnmark another two sites were ASC certified during the quarter - a testament to our strict focus on sustainability. “The third quarter was yet again characterized by solid performance for our Norwegian operations, with strong biological performance and continued high survival rates. Our post-smolt strategy in Rogaland is developing well and in Finnmark another two sites were ASC certified during the quarter - a testament to our strict focus on sustainability.

We also began to see biological improvements in BC, for which 2019 has been characterized by challenging environmental conditions. These improvements are the result of diligent, persistent work by our dedicated employees as well as extensive operational and technical solutions implemented to combat issues such as algae and low oxygen levels.”

Strategic priorities

Improving sustainability is key to increasing our profits. By focusing on reducing our environmental impact and improving fish welfare, we aim to increase harvest rates and reduce production cost. Short term, our goal is to increase production to 100 000 tonnes with a production cost at or below weighted industry average.

We aim to provide our shareholders with a competitive return on capital invested and have set a ROCE target of 12%. Our investments reflect our growth strategy: digitalization, post-smolt, biosecurity and fish welfare, including continuous evaluation of expansion opportunities.

Post-smolt improves biosecurity and survival rates and allows for a more efficient farming cycle. Increased growth on-shore also frees up sea water capacity. Digitalization in salmon farming includes applying advanced sensors, big data, artificial intelligence and automation, with the aim of generating better farming decisions.

With a strict focus on biosecurity and fish welfare, Grieg Seafood aims to achieve strong biological performance through the implementation of a broad range of technological and operational initiatives, including large smolt, GSF Precision Farming and other preventive operational measures aimed at combating sea lice and algae. The group targets an average survival rate in seawater above 93%.

GSF 2025

Grieg Seafood aims to build on its existing platform for continued sustainable growth and cost improvements going forward. With an ambition for global growth, Grieg Seafood aims to strengthen its market position while driving increased value creation as a global supplier of sustainably farmed salmon.

Grieg Seafood’s strategy for 2020-2025 is based on an ambition for sustainable salmon farming and comprises three key strategic objectives for continued growth and business development: Global growth, cost leadership and value chain repositioning.

.jpg)

Commenting on Grieg Seafood’s strategy, CEO Andreas Kvame, said:

“For several years, we have been working towards our 2020 targets of harvesting 100 000 tonnes at a cost at or below industry average, with the underlying ambition of building a platform for sustainable growth beyond 2020. Although we have faced some biological challenges in Shetland and BC, our 2020 harvest target is well within reach and costs at our Norwegian operations are developing in line with our ambitions.

We are now looking beyond 2020 and setting the direction for the next five years as we launch our GSF 2025 strategy. We will aim to build on our existing platform to ensure continued growth and cost improvements and harvest more than 150 000 tonnes by 2025. To scale our global operations, we will grow organically as well as through M&A activity. Furthermore, we will work to reposition Grieg Seafood from a pure commodity supplier to an innovation partner, increasing our presence downstream through partnerships, category development and brand cultivation. Thus, we aim to drive increased value creation as a global, integrated supplier of sustainably farmed salmon.”

Outlook

The global supply of Atlantic Salmon for 2019 is expected to increase by approximately 7% compared to 2018. With outlook for continued strong underlying demand, combined with limited growth potential in the short- to mid-term, prices are expected to increase going forward.

Click to enlarge

The Group’s total share of fixed price contracts in Q3 2019 was 30% in Norway and 20% in the UK. The share of fixed price contracts for the full year 2019 is estimated at 22% and 24% for Norway and the UK, respectively.

During Q3 2019, 6 million smolt with an average weight of 180 grams were transferred to sea. Year-to-date, 17 million smolt have been stocked to sea. For the full year 2019, a total of 26 million smolt, with an average weight around 190 grams, is planned stocked.

Grieg Seafood expects to harvest approximately 82 000 tonnes in 2019. Expected harvest volume for Q4 2019 is 24 400 tonnes, comprised of:

- Rogaland: 7 300 tonnes

- Finnmark: 10 400 tonnes

- Shetland: 3 000 tonnes

- BC: 3 600 tonnes

editorial@seafood.media

www.seafood.media

|