|

Stockpiling for a no-deal Brexit is now well under way and giving UK manufacturing a “temporary boost”

Could a Brexit bullwhip cause turmoil in European industrial production?

UNITED KINGDOM

UNITED KINGDOM

Wednesday, January 16, 2019, 21:50 (GMT + 9)

The UK newspaper Guardian reported that in the UK companies have started massive stockpiling. While this is seen as a measure to counter uncertainties around a potential hard Brexit, little has been said about the additional production needed to pile up this inventory and the effects of a substantial decrease in production this year once the inventories are sold off. Linking such active inventory decisions to supply chain understanding can only tell us one thing: even a small inventory adjustment may lead to years of instability across European supply chains.

In the Guardian article, “industry representatives” are quoted to have said: “Frozen and chilled food warehouses, storing everything from garden peas to half-cooked supermarket bread and cold-store potatoes are fully booked for the next six months, with customers being turned away”. Not just fresh and frozen food is being stockpiled. British manufacturers are also storing ingredients. UK food manufacturer Premier Food announced two weeks ago that it is building up about 10 million pounds’ worth of ingredients inventory, and British Tobacco company Imperial Brands said it would add about 30 million pounds worth of inventory.

Of course, this is good business for those leasing out warehouse property. Apparently, in many places in Southern England it is very difficult to even find qualified food-grade warehouse space. Seems like a good opportunity to bring over some reefer containers to the island as my bet is that these may be leased at a premium in the upcoming months.

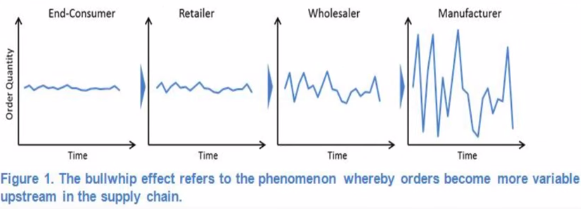

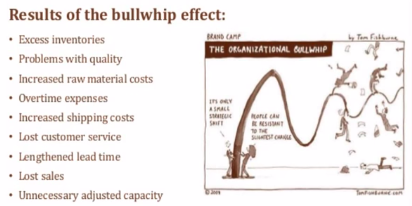

However, an aspect of stockpiling that has not received any attention in all of this is the bullwhip effect that it may cause in European industrial production. Exactly ten years ago, we conducted research that showed that the sudden decline in inventories caused by the collapse of Lehman Brothers led to massive global fluctuations in industrial output for many years. This so-called “bullwhip effect” was well-known in the literature and to anyone operating a supply chain, but common knowledge was that this was exclusively caused by demand fluctuations. Our work demonstrated that sudden, coordinated inventory adjustments would cause such fluctuations as well. I believe that this is what we will also see as a consequence of Brexit: the Brexit bullwhip.

What is a Brexit bullwhip?

I believe a Brexit-bullwhip could be facing us. The reasoning would be as follows:

Inventories of raw materials, intermediate products, and consumer products are all built up in the UK over a relatively short period of time. (Note: this is not just happening in the UK, as UK exporters will build up inventories on the continent, but I have left this out of scope in my analysis for now).

These inventories need to be produced; this leads to additional industrial production for those products sourced from the EU.

Manufacturers observe an increase in demand for their products, and hence also order more supplies from their suppliers. This surge in demand propagates upstream in the supply chain. Since supply chains are long and not very transparent, these suppliers are unlikely to relate their increase in orders to stockpiling in the UK.

At some point, the stockpiled inventory will reach their targeted level. Orders will go back to their “normal” level. It takes some time, however, before the supply chain adjusts. Cumulatively, across manufacturers, their suppliers, and again their suppliers, inventories could easily amount to a year’s worth of sales. As a consequence, manufacturers further upstream in the supply chain may only feel the consequences of the original stockpiling decisions many months later. Just like if you turn up the heating in your house; it takes some time for the system to respond and you may overheat your house.

Some time next year or in 2020, hopefully supply chains will have been adjusted to post-Brexit border controls and inventories will start to be reduced again. This will further amplify the Brexit bullwhip, leading to a huge decline in industrial production.

How large could the Brexit bullwhip be?

This is not easy to estimate. Inventory records in national statistics are not very good. Also, the complex supply chain relationships are not captured in detailed statistics. But we should be able to make a first-order estimate of the effect.

First we estimate UK imports of (physical) goods from the EU27 to be about 300 billion euros annually (1) with corresponding inventory levels to be at about 6 weeks across the board (2). This would value inventory related to UK imports from the EU at around 34 billion euros.

Second, we estimate how much additional inventory is likely to be built up as part of the stockpiling process. For this, we can only rely on anecdotal evidence from the various newspaper reports, suggesting that this is an additional month of inventory, so about 25 billion euros of additional imports from the EU, most of them likely to be purchased in quarter (Q4 2018).

.jpeg) Next we estimate total European industrial production, including the processing of agricultural products. Based on (3), we will work with a figure of about 2,500 billion euros. Next we estimate total European industrial production, including the processing of agricultural products. Based on (3), we will work with a figure of about 2,500 billion euros.

Assuming these numbers are more or less correct, this implies that the inventory build-up in the UK would be 1% of European industrial production. Since virtually all of this would have been produced in the last quarter of 2018, the last quarter would then see an additional production of about 4%. That would be a massive number.

Note that none of this includes an additional bullwhip of overreaction. Our studies of the 2008 financial crisis suggest significant overreaction since it is not clear to companies further upstream in the supply chain what causes the increase in demand.

If this were all more or less true, the rebound on the bullwhip in 2019 could be huge, with drops in import figures that would go well beyond the growth in the current quarter.

.png)

Obviously, this is an effect analyzed in isolation, and without any modeling at this stage. There are many other effects surrounding the Brexit which I am sure are receiving extensive analysis by economists in the UK, EU and elsewhere. Just today, the Bank of England released such an analysis. The Brexit bullwhip however deserves to be part of this analysis. If anyone has better numbers, I am happy to adjust my calculations accordingly.

editorial@seafood.media

www.seafood.media

|

|