|

A special feed technology has been adapted from VMK to Toyo fillet machine (Photo: FHF)

Development of new mackerel fillet technology - Japan-cut

NORWAY

NORWAY

Wednesday, May 27, 2020, 16:00 (GMT + 9)

Mackerel production is labor intensive and provides high variable costs. Through the freezing and cooling of mackerel, a relatively large proportion of the fish get a "banana-shaped" shape. This makes it difficult to fillet because banana-shaped fish must be straightened manually before it can pass on to the fillet machine.

Through the project Development of new mackerel filleting technology, a special feed technology has been adapted from VMK for herring to Toyo fillet machine for mackerel. The project has been successful and the new customized and further developed feed part from VMK has now been implemented and put into use by the industry. Through the project Development of new mackerel filleting technology, a special feed technology has been adapted from VMK for herring to Toyo fillet machine for mackerel. The project has been successful and the new customized and further developed feed part from VMK has now been implemented and put into use by the industry.

The market for mackerel fillets is growing in Japan and Korea. Importers in these two countries buy to a greater extent from China where processing takes place today. 350,000 tonnes are landed in Norway where 180,000 tonnes are exported to Japan. The goal is to increase domestic processing so that 25% of exports will be in the form of fillets, by 2025.

Added value

Norwegian production of mackerel has so far been in the form of round frozen fish. Only 2.3% of Norwegian landings are processed into fillets.

When fish are landed and packed round frozen, all residual raw material is also shipped out of the country. Norwegian companies thus miss the value of the large volume of residual raw material contained in the catch.

The aquaculture industry needs marine protein and marine fatty acids for salmon farming.

Employment

The industry is gaining greater use of the volume of mackerel that can be processed at Norwegian plants. It is considered that the potential value of mackerel for filleting could significantly increase employment. However, it requires a fillet and a production technique that is so efficient that it can compete with similar production in low-cost countries.

Competitive advantages

In collaboration with the pelagic industry, FHF has made a greater effort to increase the processing of mackerel. The initiative is called “Pelagic lift - increased processing of mackerel”. As part of this initiative, it is part of a development work for filleting technology. This project is part of the initiative and anchored in the FHF's Action Plan for 2016.

New technology with automatic processes reduces the benefits of low-cost production. Increased demand for Norwegian-produced mackerel fillets has also helped to change the market's interest in processed mackerel from Norway. Increased processing creates opportunities, but also challenges for companies in the pelagic industry.

Increased technology level

When switching from packing and freezing round to processed mackerel, several challenges must be solved. The challenges are many and exist along the entire value chain, from receiving to developing new market opportunities. To succeed, it is important to develop new technological solutions. When switching from packing and freezing round to processed mackerel, several challenges must be solved. The challenges are many and exist along the entire value chain, from receiving to developing new market opportunities. To succeed, it is important to develop new technological solutions.

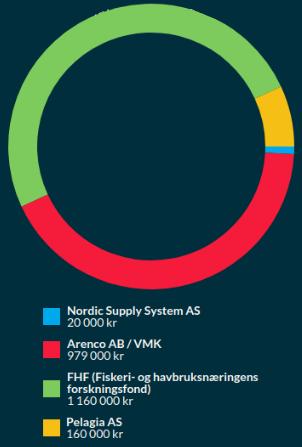

►FHF provide 50% of the budget and Arenco/VMK the 42%

The development of new technological solutions poses challenges in cutting a fillet with a fine cut surface, sufficiently high capacity, product handling, automation and production and investment costs.

It is a wish from the pelagic industry that one will be able to solve the challenges associated with automatic feeding, head cutting, tail cutting and filleting of mackerel. In addition, the project will develop technology for finishing and automatic quality sorting of the finished fillet.

In this project, one wants to utilize existing VMK machines. It will provide higher capacity than existing technology in the market. This will also make production more rational.

Health, environment and safety (HSE) will also be improved by a higher degree of automation.

The project takes place in close and binding cooperation with Pelagia AS

Performance targets

• Developing technology for automatic filleting of the Japan-cut fillet with temperature from minus 1.5 to minus 3 ° C.

• To adapt the new equipment to the existing production line for the Norwegian pelagic industry.

Sub-goals

• Handling “frozen” mackerel throughout the VMK line, (VMK52 / VMK31 / VMK16 / VMK11) including automatic feed.

• The unit for the fillet should be able to be mounted on an existing VMK11 fillet machine.

• The unit must be mechanical.

• The unit for the fillet should be dismantled so that production of the “Euro-cut” fillet can be carried out in the same machine.

• The unit should have a production capacity of 150 fish per minute.

• The unit's design is easily and efficiently adapted to cleaning and hygiene.

• Residual raw material, which smashed and fed, is transported together with the back bone.

• The interface must meet the market requirements and specifications.

• The fillet control and post-cleaning unit should be included (as a separate device).

The VMK31 (left) orientates the fish head first and belly down in four rows, side-by-side, Feeder wheels secure that the fish is fed synchronized with the fish pockets in VMK16 (right).

Expected utility

Increased processing of mackerel results in increased revenue and increased value creation for the Norwegian pelagic industry. It also provides increased utilization of residual raw material and thereby greater utility for the Norwegian fishing industry. The advanced technology will be of great importance for the further development of the pelagic industry.

Increased processing of mackerel also has an effect on the environment, as the residual raw material can be used for the production of fishmeal and raw material for the aquaculture industry. With a gradual transition to fillet production, the volume of goods transported to overseas markets will also be reduced. This will result in lower CO₂ emissions and higher environmental impact.

Compared to today's technology for the production of the same product, the industry will significantly increase production capacity. Automatic production will also increase the rationalization of the business. This in turn increases the competitiveness of the Norwegian pelagic industry.

The VMK11 Filleting Machine accurately and efficiently removes the guts and bones of the fish, while cutting high-yield butterfly fillets

There is also an expected benefit in that the technology provides an improved HSE effect in the company.

A successful result will result in a short payback period. The use of resources is therefore proportionate to potential utility.

Completion

The project is divided into three stages with underlying steps.

VMK's fillet line consists mainly of three different machines: Automatic Feeder (VMK31), Head Cutter (VMK16), and Filet Machine (VMK11). It is necessary to customize each machine separately in order to handle "frozen" mackerel.

Phase 1: Filtering mackerel exclusively with “Japan-cut” in VMK11

- Step 1 - Concept development and data collection.

- Step 2 - Small scale testing in VMK's own test room.

- Step 3 - Test with Norwegian manufacturer.

Source: FHF

editorial@seafood.media

www.seafood.media

|