|

Sanford Interim Results – Diversity Providing Resilience For New Zealand’s Largest Seafood Company

NEW ZEALAND

NEW ZEALAND

Thursday, May 28, 2020, 15:00 (GMT + 9)

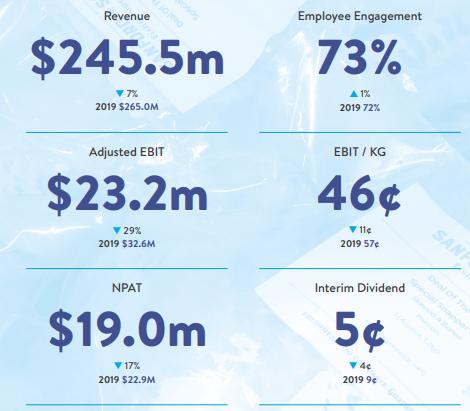

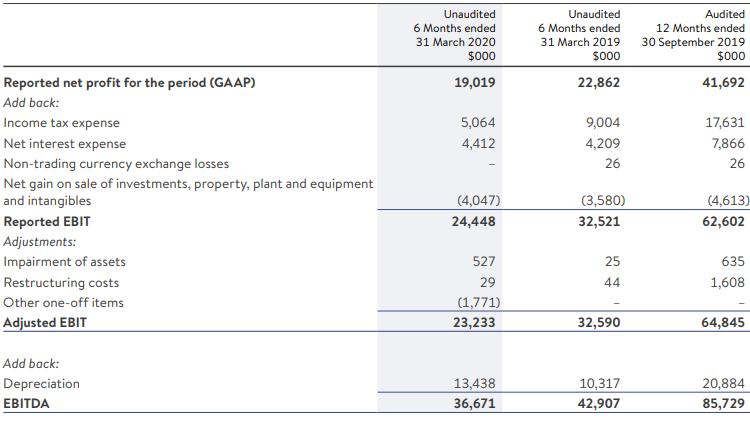

Sanford Limited (NZX: SAN) has reported statutory net profit after tax (NPAT) for the first half of its 2020 financial year of $19.0 million, 17% behind last year’s result of $22.9 million for the same period. Adjusted (underlying) Earnings Before Interest and Tax (EBIT) of $23.2 million for the six months to 31 March, 2020. This represents a 29% decrease on adjusted EBIT from the same period last year ($32.6 million) or a 16% decrease on a comparable basis, when excluding the pelagic business which Sanford sold in March 2019. Total revenue was $245.5 million, a 7% decrease on the same period in 2019 ($265.0 million).

Sanford is New Zealand’s largest and oldest seafood company and has a diverse range of interests across fishing and aquaculture. In recent years, it has made a strategic shift into higher value products such as Greenshell mussel powders and high end branded salmon.

The company’s first half results were impacted in its fishing division by a shortfall in catch volumes for toothfish, caused in part by weather factors. Pricing for this species was also softer globally, following the impact of COVID-19. Coronavirus impacts were also felt in other areas of the business, particularly toward the end of the reporting period. The sale of Sanford’s Tauranga-based pelagics business (catching mackerels and tuna) at the end of March 2019, accounted for the sales volume difference to prior year. The company’s first half results were impacted in its fishing division by a shortfall in catch volumes for toothfish, caused in part by weather factors. Pricing for this species was also softer globally, following the impact of COVID-19. Coronavirus impacts were also felt in other areas of the business, particularly toward the end of the reporting period. The sale of Sanford’s Tauranga-based pelagics business (catching mackerels and tuna) at the end of March 2019, accounted for the sales volume difference to prior year.

Despite the challenges, the company noted that normalised EBIT per greenweight kilogram improved across its aquaculture business with salmon at the Stewart Island farm showing particularly good growth with a 19% increase in bio-mass.

However, this wasn’t enough to counter the shortfall in the highly valuable toothfish catch and softer pricing, leading to an overall EBIT/kg decrease to $0.46 from $0.57 on the prior year.

CEO Volker Kuntzsch noted that, while the overall interim result was below expectations, there was clear strength in salmon and Greenshell mussels, demonstrating the benefits of Sanford’s transition into a more diverse company. CEO Volker Kuntzsch noted that, while the overall interim result was below expectations, there was clear strength in salmon and Greenshell mussels, demonstrating the benefits of Sanford’s transition into a more diverse company.

“We were pleased that overall sales volumes for our salmon were up 2% versus the same period last year and sales revenue increased 6%. Our Big Glory Bay grown salmon are exceptional and have been highly sought after in some of the world’s finest restaurants. Unfortunately, food service channels have been severely impacted by COVID-19. Domestic retail sales have been holding up well and we are hopeful of continuing growth here.”

Mr Kuntzsch pointed out that Sanford’s strategy to address the relatively volatile performance of the fishing business is a long term one.

“Our aquaculture operations are relatively young but development there, through investments into operational excellence, market development, a focus on higher value sales channels and innovation, tend to bear fruit much faster than in fishing. Our mussel hatchery, SpatNZ, our mussel powder operation, Enzaq, and the activities leading to improved growth of our salmon are just a few of the highlights. The projects we have underway in our diverse fishing division, both inshore and in the deep sea fleet are going well, but they are substantial undertakings requiring significant investment of capital, time and expertise and therefore require our patience as we tackle the move from commodity to added value, species by species.”

Regarding the impact of the coronavirus on Sanford, the company’s Chief Financial Officer, Katherine Turner says being an essential business was a privilege, which did provide some protection against the impacts of the response to the virus, but never the less, the company was affected. Regarding the impact of the coronavirus on Sanford, the company’s Chief Financial Officer, Katherine Turner says being an essential business was a privilege, which did provide some protection against the impacts of the response to the virus, but never the less, the company was affected.

“We did experience a short interruption to normal operations in March while we put in place changes right across the business which were necessary to meet Government COVID-19 safety requirements. However, thanks to incredible efforts from our fishing, farming and processing teams, we were able to return to relatively normal operations and supply levels within two weeks.

The issues we face now are on the demand side. Consumer behaviour has changed and the foodservice industry is impacted through restrictions on people’s movements and the absence of tourism. We are very conscious of the challenges faced by many of our customers. Retail and on-line sales, although only a small share of our total business, show strong growth and we are aggressively pursuing further leads in these areas.”

Mr Kuntzsch acknowledges the volatile demand and the uncertain future and believes it is unlikely that the company will be able to make up the first half earnings shortfall in the second half of the year.

He says “in the interests of taking a prudent approach, our directors have decided that our interim dividend payment will be 5c per share (versus 9c for the same period last year).”

Sanford is producing larger King Salmon, partly due to increased oxygenation of the fish enclosures and an enhanced net cleaning regime which also improves oxygen levels. In addition to the fish being larger, they also experienced lower salmon mortalities as a result of above mentioned activities and cooler water temperatures throughout the period.

But he says despite the global uncertainty caused by the virus and its impacts in the near future, Sanford has many reasons to be positive about the long term.

“We are a vertically integrated food producer with diverse products on offer through a wide range of channels and into a variety of markets. Our seafood is a sustainable, healthy and clean protein. The COVID-19 pandemic has seen our people step up to the challenge, demonstrating that they are a resilient, determined and caring group. We are very proud of what our people have already achieved, as we move into a future of challenge and change.”

editorial@seafood.media

www.seafood.media

|