|

SalMar still expects to harvest 155,000 tonnes in 2019 as a whole

SalMar posts improved results for Q2 2019

NORWAY

NORWAY

Monday, August 26, 2019, 00:10 (GMT + 9)

SalMar ASA posted an Operational EBIT of NOK 989.8 million (USD 110.37 million) in the second quarter 2019, an increase of 12.6 percent compared with NOK 878.6 million in the same period last year.

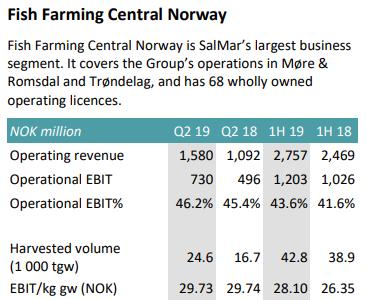

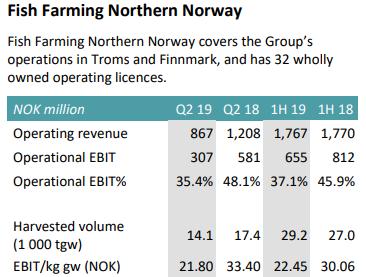

The company says the improvement is attributable largely to effective operations, lower production costs and a higher volume harvested by Fish Farming Central Norway. At the same time, biological challenges resulted in a more demanding quarter than expected for Fish Farming Northern Norway.

.jpg)

“It is very good to see that Central Norway continues the positive trend and shows that good biological performance gives good financial results. Biological challenges made the quarter demanding for Northern Norway, where we chose to harvest the fish earlier than planned to minimise the biological risk, but we see a clear improvement from the fourth quarter,” says SalMar’s CEO Olav-Andreas Ervik.

.jpg) Gross operating revenues totalled NOK 3.3 billion in the second quarter 2019, up 13.8 percent from NOK 2.9 billion in the same period last year. Gross operating revenues totalled NOK 3.3 billion in the second quarter 2019, up 13.8 percent from NOK 2.9 billion in the same period last year.

The Group harvested 41,400 tonnes during the quarter, compared with 34,000 tonnes in the second quarter 2018.

SalMar achieved an Operational EBIT per kg of NOK 23.90, down NOK 1.90 per kg on the same period last year. The decrease is largely attributable to weaker results from Fish Farming Northern Norway, as well as the consolidation of the Icelandic producer Arnarlax with effect from 1 February 2019.

.jpg)

As expected, Fish Farming Central Norway increased its volume harvested in the second quarter 2019 compared with the same period last year. The majority of the fish harvested were transferred to sea farms in the spring of 2018, a generation that has performed well biologically. This resulted in increased earnings compared with both the previous quarter and the second quarter 2018. SalMar will continue to harvest the spring-2018 generation in the third quarter, and expects a slightly higher volume and costs at the same lever compared with the second quarter.

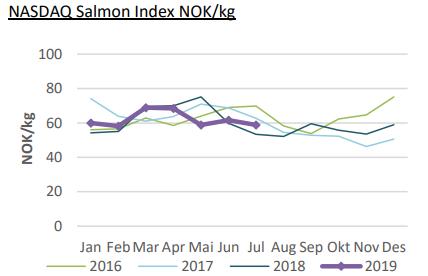

Fish Farming Northern Norway performed weaker than expected. This is primarily attributable to earlier harvest than planned to reduce biological risk in particular related to the algae bloom at the end of May. Premature harvesting resulted in a lower average weight for the fish, and therefore lower price achievement and higher costs. The algae bloom also negatively impacted price achievement, since several fish farmers were forced to harvest their stocks early, causing a large amount of salmon in the market. SalMar expects a substantially lower volume from Fish Farming Northern Norway in the third quarter, with consequently higher costs. However, both volume and costs are expected to improve in the fourth quarter.

Compared with the same period last year, Arnarlax posted substantially improved results in the second quarter 2019, due to both a higher volume harvested and improved biological performance. However, the result was somewhat impaired by the fact that no fish were harvested in June, which resulted in higher fixed costs per kilo. Arnarlax expects a slightly lower volume and a stable cost position in the third quarter.

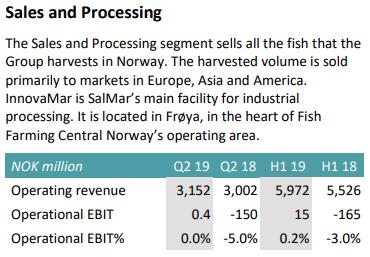

.jpg)

The Sales and Processing segment posted a profit of NOK 0.4 million in the quarter, compared with a loss of NOK 150 million in the same period last year. The year-on-year improvement resulted from the fact that fixed-price contracts have a higher stipulated price than in the corresponding quarter last year. The decrease from the previous quarter is due to lower price achievement, caused primarily by the premature harvesting of fish in Northern Norway at a low average weight.

As at 22 August, the contract rate stands at 27 per cent for the third quarter 2019 and 20 per cent for 2019 as a whole. Contract prices are somewhat higher than last year’s level.

The global supply of Atlantic salmon in 2019 is expected to increase by around 6 per cent. Combined with expectations of strong demand, this indicates a balanced salmon market with the likelihood of continued good earnings.

SalMar still expects to harvest 155,000 tonnes in 2019 as a whole: 145,000 tonnes in Norway and 10,000 tonnes in Iceland (Arnarlax) but increases their expectations to 97,000 tonnes in Central Norway and similarly a bit down to 48,000 tonnes in Northern Norway. Norskott Havbruk (Scottish Seafarms) expects to harvest 30,000 tonnes.

Click here to download the SalMar Q2 2019 report

(1 NOK = 0.11151 USD)

editorial@seafood.media

www.seafood.media

|

|