|

Photo: Norwegian Seafood Council

These countries eat the most Norwegian salmon

WORLDWIDE WORLDWIDE

Wednesday, June 26, 2024, 06:50 (GMT + 9)

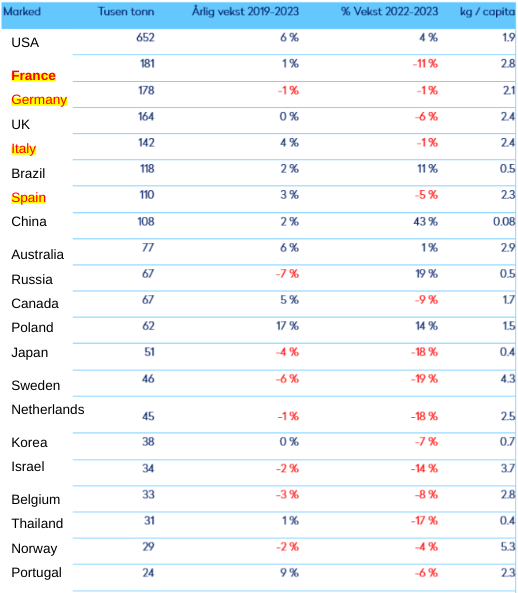

Using trade statistics and production estimates, Norway's Seafood Council calculates the consumption of Atlantic salmon in various markets each year. The table below shows the 20 largest markets for Atlantic salmon in 2023.

The 20 largest markets for the consumption of Atlantic salmon

All countries marked in red had a decline in consumption in 2023. At the top, as usual, we have the USA, which consolidates its dominance as the world's preferred market for Atlantic salmon, and continues the solid growth we have seen over several years. All five major European markets (France, Germany, Great Britain, Italy and Spain) had a decline in consumption from 2022 to 2023. Since 2019, however, both Italy and Spain have excelled with solid consumption growth.

Among the other large markets we find Brazil, which benefits from geographical proximity to the major producer Chile, as well as Australia and Canada, which produce a lot of salmon themselves. Russia produces some salmon itself, but also imports significant volumes from Chile, while the processing market Poland has had a very strong consumption trend in recent years. Otherwise, among the top 20, we have several Asian markets such as Japan, South Korea, Israel and Thailand, all of which had a significant decline in consumption in 2023.

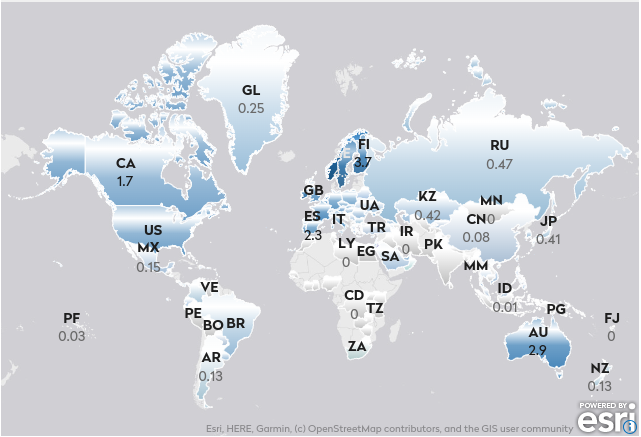

Here is a world map of all salmon markets for which we have estimated consumption. Each country is color-coded according to consumption per capita, where a higher consumption per capita gives a darker color.

Consumption of Atlantic salmon per capita - 2023

Certain countries with a lot of transit/processing and re-export of salmon have been omitted due to uncertain estimates.

Growth markets

China was the largest growth market in 2023. The country reopened society approximately one year after the rest of the world. Since most of the salmon in China is sold in restaurants, the reopening resulted in a large increase in the demand and consumption of salmon in this market. China also has a very low per capita consumption, and with a middle class of several hundred million inhabitants, there is great potential for continued growth in salmon consumption in China.

The US had the second highest growth last year. Since 2013, consumption in the US has increased by around 7% annually. In comparison, the corresponding growth rate in the EU was around 3%. Over time, we also see that Norwegian salmon, either directly from Norway or via processing nations, has greater growth than the total market in the USA. Norwegian salmon's share of the American market was around 22% in 2023, compared to 16% in 2016. In 2023, Norwegian salmon's market share was up half a percentage point from 2022.

Brazil is the third largest growth market in 2023. Only small quantities of smoked and processed salmon exported from Norway to Brazil were recorded last year. The value was just under one million kroner. The Brazilian market consists almost 100% of Chilean salmon.

.png)

The figure below shows the 5 markets with the greatest growth in consumption last year.

Russia has almost as much growth as Brazil. After a large volume decline in 2022, the market has corrected upwards in 2023. The Faroe Islands stopped exporting to Russia in 2022, while Chile also reduced exports to Russia significantly in the same year. 2023 is characterized by a large increase in the supply from Chile, which contributed to solid growth in salmon consumption in Russia.

Estimated consumption in Poland increased by 7,500 tonnes in 2023, which corresponds to a whopping 14 percent growth from 2022. This places Poland in 5th place in the overview of largest growth markets. For processing markets such as Poland, it is challenging to calculate consumption precisely. Inaccuracies both in trading statistics, conversion factors and changes in stock can affect the result.

For Poland, data for home consumption from GfK shows that salmon consumption increased somewhat from 2019 to 2023, but no growth in consumption from 2022. There may of course have been a sharp increase in outdoor consumption in Poland last year, helped by increased tourism. We still have to live with, and keep in mind, that estimates for processing markets such as Poland are somewhat uncertain.

.png)

Markets with the biggest decline

In the list of biggest reduction markets last year, it is France that falls the most. After a violent growth in 2021 of as much as 27 percent, we had a reduction of 13% in 2022 and a further fall of 11% in 2023. Despite the fall in the last two years, consumption in 2023 was 4% higher than before the pandemic ( 2019).

Japan had the second biggest decline. This is a market where transport costs increased a lot as a result of closed Russian airspace for many European airlines. Increased prices in the world market together with increased transport costs and a weak currency have reduced imports in 2023.

Sweden is a market where consumption per capita is at the very top of the world. Consumption increased to a record high volume in 2021, but in line with increased prices, consumption has fallen in this market.

In Great Britain, very high inflation has made a big dent in the purchasing power of the British consumer, which has had an impact on salmon consumption last year. Both imports and own production of salmon fell in the UK in 2023.

.jpeg) The Netherlands is a market with high processing and re-exports, and estimates from there are more uncertain. From our home consumption figures, however, we see the same decline in consumption in 2023 as our estimates. The Netherlands is a market with high processing and re-exports, and estimates from there are more uncertain. From our home consumption figures, however, we see the same decline in consumption in 2023 as our estimates.

Photo: Norwegian Seafood Council -->

The home consumption figures also show that the price of salmon in groceries has increased significantly more in the Netherlands than in other European markets in 2023, which may have contributed to a decline in consumption.

The prospects ahead

Prospects for weak global production growth limit how much consumption can increase. The biggest uncertainty is related to whether the weak development in Europe will reverse, and whether China and the USA will continue to be the major growth markets.

With higher salmon prices, it is the most price-sensitive consumers and buyers who fall away first. This means that if the salmon price continues to remain high, it is typically outdoor consumption that will remain the strongest, i.e. consumption at hotels, restaurants and catering. This is because the salmon in this segment take advantage of what is called in economic terms "the importance of being unimportant".

For a sushi board, or a salmon dinner at a restaurant, there are many other costs than the salmon price that determine what the meal costs. A higher salmon price thus has little effect on the price of the meal. For a salmon fillet in grocery stores, on the other hand, it is the salmon price that makes up most of the cost of the product. For a sushi board, or a salmon dinner at a restaurant, there are many other costs than the salmon price that determine what the meal costs. A higher salmon price thus has little effect on the price of the meal. For a salmon fillet in grocery stores, on the other hand, it is the salmon price that makes up most of the cost of the product.

If the export price of salmon increases, the grocery chains have to increase the retail price far more (in percentage terms) than the sushi restaurant. Thus, markets with a high level of outdoor consumption may experience a stronger development if the salmon price increases, while we get a weaker development in markets where most of the salmon is bought in shops and prepared at home.

<-- Photo: Norwegian Seafood Council

Countries such as the USA, China and other Asian markets, as well as Italy and Spain in Europe, have a relatively high external consumption of salmon, and are markets that will be more robust in the face of possible price increases. In the opposite case, without a price weight, it becomes more attractive for grocery chains to run campaigns, and we can get a stronger consumption trend in markets with high home consumption.

Sweden and Germany are examples of markets with a high proportion of home consumption. With prospects for a tight supply side in the coming years, we believe that outdoor consumption can have the strongest development.

Prepared salmon products in groceries will also become increasingly important. The convenience trend continues in full swing, and this also applies to the salmon. Both by introducing more flavors and choices for consumers, as well as by making the price of the salmon itself a smaller part of the total retail price, an increase in the range of prepared salmon products can make demand more robust against fluctuations in the price of salmon.

The economic development will affect consumption. Although many driving forces come into play, we believe that the high inflation and the decline in purchasing power have had a significant effect on consumption in Europe in particular in recent years. Now that the economic outlook in Europe looks somewhat brighter, this could be positive for demand.

Source: Norwegian Seafood Council

editorial@seafood.media

www.seafood.media

|