|

Photo: VASEP/FIS

VASEP on Vietnam's Tuna Exports: Growth in the Middle East, Challenges in the U.S.

VIET NAM

VIET NAM

Friday, March 21, 2025, 03:00 (GMT + 9)

Strong Growth in the Middle East

Vietnam's tuna exports to the Middle East continued their impressive growth in 2024, rising by 28% compared to 2023.

.png) According to Ms. Nguyen Ha, Tuna Market Expert at the Vietnam Association of Seafood Exporters and Producers (VASEP), the Middle East has solidified its position as one of Vietnam’s top four tuna export markets. According to Ms. Nguyen Ha, Tuna Market Expert at the Vietnam Association of Seafood Exporters and Producers (VASEP), the Middle East has solidified its position as one of Vietnam’s top four tuna export markets.

A Promising Market

Vietnam Customs data shows that in 2024, tuna exports to the Middle East reached nearly $113 million, ranking fourth after the U.S., EU, and CPTPP countries. Vietnamese tuna products are now present in most countries within this bloc, with Israel, Lebanon, and Egypt emerging as the largest importers.

Israel leads the region in tuna imports from Vietnam and is now the second-largest single market after the U.S., accounting for nearly 7% of total tuna export value in 2024—a 30% increase from 2023. Other countries such as Lebanon, Egypt, Saudi Arabia, and the UAE also recorded strong double-digit growth.

.jpeg)

Click on the image to enlarge it. Source: VASEP

Vietnam’s recent signing of the Comprehensive Economic Partnership Agreement (CEPA) with the UAE is expected to further boost tuna exports. The UAE, a key economic hub in the region, is a major destination for Vietnamese seafood. Both countries aim to complete the CEPA ratification by Q1 2025, after which Vietnamese tuna exports to the UAE will enjoy a 0% tariff, enhancing their competitiveness.

Challenges in the Middle East

Despite its potential, the Middle Eastern market presents challenges, particularly regarding Halal certification. The Halal standard requires seafood products to be processed and certified in accordance with Islamic law, necessitating significant investment in compliance, quality control, and inspections.

With the global Muslim population projected to grow by 50% by 2050, reaching 2.76 billion, the Halal food market is expected to expand rapidly, driven by investment and technological advancements. If Vietnam can meet UAE Halal standards, it will unlock vast opportunities across the region.

However, inconsistent Halal certification processes across countries remain a major hurdle. The lack of a unified standard complicates compliance for Vietnamese businesses entering new markets. Clear guidelines on ingredient requirements and certification procedures are crucial for Vietnam to expand its presence in the Halal food sector.

New Challenges for Tuna Exports to the U.S.

Vietnam's tuna exports to the U.S. face increasing challenges following a preliminary ruling by the National Oceanic and Atmospheric Administration (NOAA). The ruling questions the equivalence of Vietnam’s marine mammal management and conservation measures, potentially affecting future tuna exports.

The U.S.: Vietnam’s Top Tuna Market

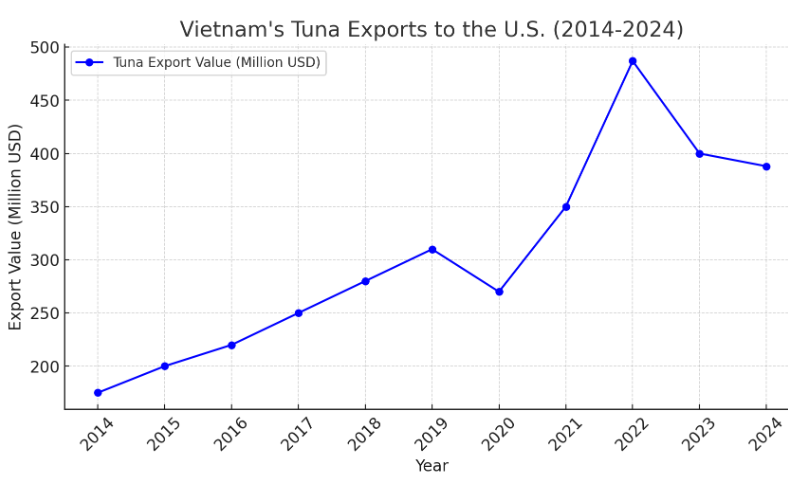

The U.S. has surpassed Japan to become the world's largest tuna importer and has remained Vietnam’s leading export market for over a decade, accounting for more than 35% of Vietnam’s total tuna export revenue.

Between 2014 and 2019, Vietnam’s tuna exports to the U.S. showed steady growth, peaking at $487 million in 2022. Despite a temporary decline during the COVID-19 pandemic in 2020, exports rebounded, reaching $388 million in 2024—more than double the $175 million recorded in 2014.

The U.S. is Vietnam’s primary importer of canned tuna and tuna loins, making any regulatory challenges in this market highly consequential.

Regulatory Barriers and Political Uncertainty

The global seafood market is increasingly influenced by political shifts, tariffs, and changing consumer demand, and the U.S. is no exception.

The Marine Mammal Protection Act (MMPA), enforced since January 1, 2017, regulates seafood imports to prevent the unintentional capture of marine mammals in foreign fisheries. The Marine Mammal Protection Act (MMPA), enforced since January 1, 2017, regulates seafood imports to prevent the unintentional capture of marine mammals in foreign fisheries.- NOAA's recent preliminary ruling suggests that Vietnam lacks sufficient monitoring and management measures to comply with U.S. marine mammal protection standards.

- If Vietnam fails to provide additional evidence of compliance by April 1, 2025, NOAA may finalize the ruling by November 30, 2025.

- Failure to meet these requirements could result in a ban on Vietnamese tuna exports to the U.S. from January 1, 2026.

Vietnam’s Response

With only a few weeks left before the April 1 deadline, urgent action is required to ensure compliance.

VASEP has submitted Document No. 20/CV-VASEP (dated February 24, 2025) to the Ministry of Agriculture and Environment, outlining necessary measures to align Vietnam’s fisheries management with U.S. standards. Businesses are urging the government and relevant agencies to act swiftly to prevent disruptions in tuna exports to the U.S.

Vietnam must demonstrate concrete progress in implementing marine mammal conservation measures to maintain access to the U.S. market. The coming months will be crucial in determining the future of Vietnamese tuna exports to the U.S.

editorial@seafood.media

www.seafood.media

|