The China Ocean-Going Squid Price Index is a joint initiative by Zhejiang Zhoushan International Agricultural Products Trading Center Co., Ltd., and Shuliang Technology. This index provides a reference for tracking domestic squid price trends but does not serve as specific market advice, according to Shuliang Technology’s Oceanic Squid Index of China.

.png)

For November 2024, the index was calculated using price data from major squid fishing regions, processed through Shuliang Technology's index model. This ensures an authoritative and scientific analysis for manufacturers and consumers.

1. Overall Index Performance

Data from Zhejiang Zhoushan Trading Center indicates a slight decline in the monthly squid price index in November 2024, ending a three-month upward trend. Despite this, the index remained higher than the same period last year. The weekly index fell during the first two weeks of November before stabilizing, closing at 229.35 points, down 2.45% from the end of October.

2. Monthly Price Index Trends

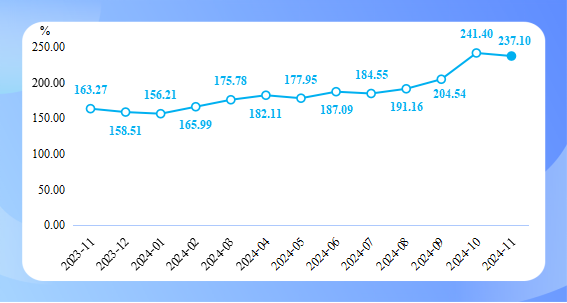

In November 2024, global squid catches improved, alleviating tight supply conditions. The China Ocean-Going Squid Price Index closed at 237.10 points, a slight drop of 1.78% from October but a significant increase of 45.22% compared to November 2023.

Figure 1 Trend of China's Ocean Squid Price Index (monthly)

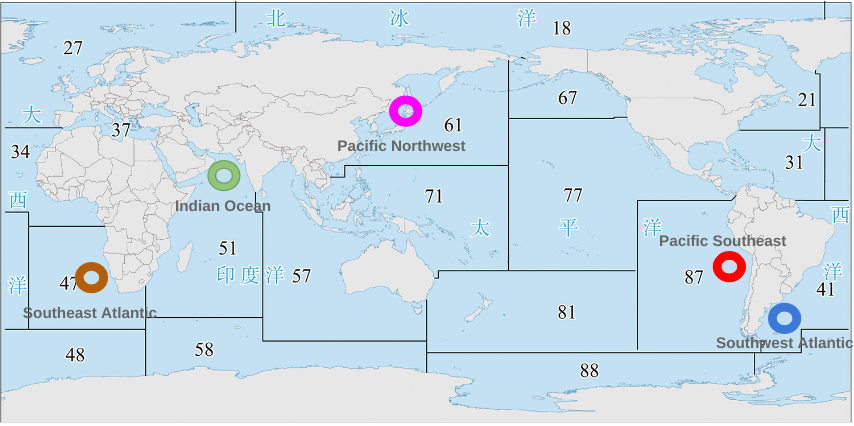

Trends by region included:

- Southeastern Pacific Ocean: Improved catches pushed the index down to 248.67 points, a 3.43% month-on-month decline.

- Southwest Atlantic Ocean: Inventory-driven transactions raised the index to 209.48 points, up 1.48% month-on-month.

- Northwest Pacific Ocean: Increased catches caused a slight drop, with the index closing at 219.82 points, down 1.34%.

- Indian Ocean: Price growth slowed but remained positive, closing at 230.25 points, a 7.12% increase, though growth narrowed by 6.93 percentage points compared to the previous month.

Overall, fluctuations in regional price indices have stabilized, signaling a more balanced squid market.

.png)

Figure 2 Monthly price index trend of pelagic squid in various sea areas

3. Weekly Price Index Trends

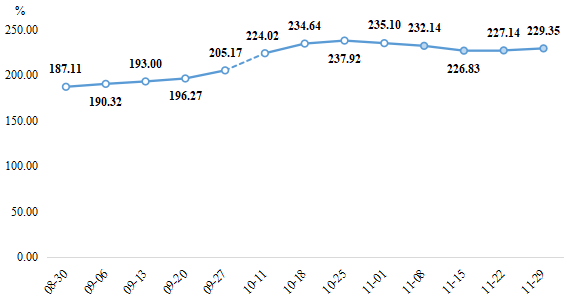

In November, the weekly squid price index showed a rebound after an initial decline. The index ended at 229.35 points, down 2.45% from October’s close.

- Weeks 1-2 (Nov 2–15): The index fell to 226.83 points, a 3.52% decline from October.

- Weeks 3-4 (Nov 16–29): Prices rose steadily in a narrow range, ending at 229.35 points, up 1.11% from the second week.

Regional Weekly Trends:

- Southeastern Pacific: Mirroring the overall trend, the index ended at 251.84 points, a 2.45% decrease from October.

- Southwest Atlantic: Minimal fluctuations with a slight rebound followed by decline, closing at 167.67 points, down 0.97%.

- Northwest Pacific: The index remained stable across three weeks, with a minor decline in the second week.

Figure 3 Trend of China’s Ocean-going Squid Price Index (weekly)

In terms of details, the weekly price index of squid in the four major sea areas showed different trends, but overall they all declined to varying degrees. The weekly price index of squid in the Southeastern Pacific Ocean was similar to the overall index to a certain extent, falling first and then rising. The index closed at 251.84 points at the end of November, down 2.45% from the end of October. The weekly price index of squid in the Southwest Atlantic Ocean had the smallest fluctuation, showing a slight rebound and then continued decline. It closed at 167.67 points at the end of November, down 0.97% from the end of October. The weekly price index of squid in the Northwest Pacific Ocean remained flat month-on-month for three of the four weeks, and only declined in the second week. The index closed at 202.53 points at the end of November, down 5.12% from the end of October. Combined with the upward trend of the monthly price index and the index performance of each week of last month, the weekly price index of squid in the Indian Ocean this month has obviously tended to be stable. The index closed at 243.42 points at the end of November, down 4.92% from the end of October.

Click on the image to enlarge

4. Index trend forecast

At present, the supply of squid market is gradually increasing with the improvement of fishing conditions in the Southeastern Pacific Ocean, but the market generally expects that the tight supply situation may continue until the end of 2024 or early 2025. With the continued release of holiday demand at the end of the year and the further clarification of fishing dynamics in the production area, it is expected that the squid price index will remain high and fluctuate in the short term.

Based on the technical report of the National Fisheries Development Institute (INIDEP) and the successful experience of early fishing in the past few seasons, the Federal Fisheries Council (CFP) passed a resolution on November 14, 2024, announcing that the 2025 squid fishing season will start early on January 10, 2025 in the area south of 44 degrees south latitude. In addition, the water temperature in the offshore waters of Peru has returned to normal, basically close to the water temperature indicators of previous years, and the growth environment of squid is guaranteed. Therefore, in the medium and long term, the supply of the squid market is likely to improve, and the price index is likely to fall.