|

The consumption of aquatic products through e-commerce channels has increased significantly

Report of imported seafood in China during 2022

CHINA

CHINA

Thursday, February 02, 2023, 07:00 (GMT + 9)

The import volume hits a new high! The price of multi-category raw materials is soaring, and the consumption potential of imported aquatic products is huge!

After three years of the impact of the epidemic, China's total imports of aquatic products will rebound in 2022, and imports of multiple categories will hit new highs. Under China's huge aquatic product consumption market, the imported aquatic product industry is expected to recover significantly in 2023! Looking back at the imported aquatic products and catering market in 2022, what trends can we discern? After three years of the impact of the epidemic, China's total imports of aquatic products will rebound in 2022, and imports of multiple categories will hit new highs. Under China's huge aquatic product consumption market, the imported aquatic product industry is expected to recover significantly in 2023! Looking back at the imported aquatic products and catering market in 2022, what trends can we discern?

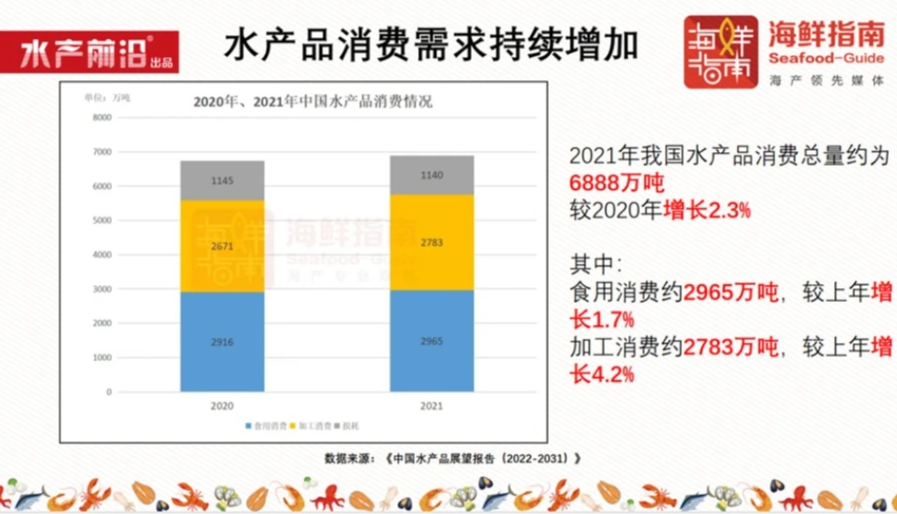

Aquatic products are rich in high-quality protein, low in fat, and rich in unsaturated fatty acids, which help promote brain development and maintain cardiovascular and cerebrovascular health. In 2021, the total consumption of aquatic products in China will reach 68.88 million tons. Driven by the huge and continuously growing demand for aquatic products consumption, as the living standards of Chinese residents continue to improve, the imported aquatic products industry is also ushering in explosive development.

However, due to the impact of the new coronavirus epidemic, the rapid development of China's imported aquatic products industry has slowed down in 2020. Difficulties such as customs clearance obstacles, high import costs, and returned goods have shrouded the imported aquatic products industry under the haze of the epidemic for a long time.

.jpeg)

The good news is that the growth rate of China's total aquatic product imports will exceed 25% in 2022, and it will finally usher in a significant rebound after two years of decline. At the same time, the adjustment and optimization of China's imported cold chain food epidemic prevention and control measures in 2023 will greatly reduce the impact of the epidemic on imported aquatic products. It is foreseeable that under China's huge aquatic product consumption market, the imported aquatic product industry will release more potential in 2023.

Looking back on China's aquatic industry in 2022, it has experienced many challenges, but it also gave birth to unlimited opportunities. Looking back on the past is to move forward better.

Inventory of Seafood Events in 2022

Finally, Seafood Guide released the 2022 China Imported Aquatic Products Report, summarizing the data of China's main imported aquatic products in the past year, and gaining insights into the new trends of China's imported aquatic products industry and aquatic catering consumption market for reference by industry players.

China's imports of aquatic products have stagnated and rebounded in the past three years, and the total import volume in 2022 will increase by more than 25% year-on-year

In 2022, China's total import of aquatic products will reach 4.54 million tons, an increase of about 25.1% year-on-year, and the total import value will be US$19.84 billion, a year-on-year increase of 37.3%. The second highest increase in five years.

In 2022, February, July, and August will be relatively low imports of aquatic products, and January, July-August, and November-December will be relatively peak values. On the one hand , China's import volume of aquatic products is greatly affected by the epidemic situation: when the domestic epidemic situation is severe and catering consumption is greatly affected, the total import volume of aquatic products has declined; on the other hand , in China's traditional golden period of consumption, For example, before the Spring Festival and National Day holidays, the total import volume of aquatic products will be at a relatively high value.

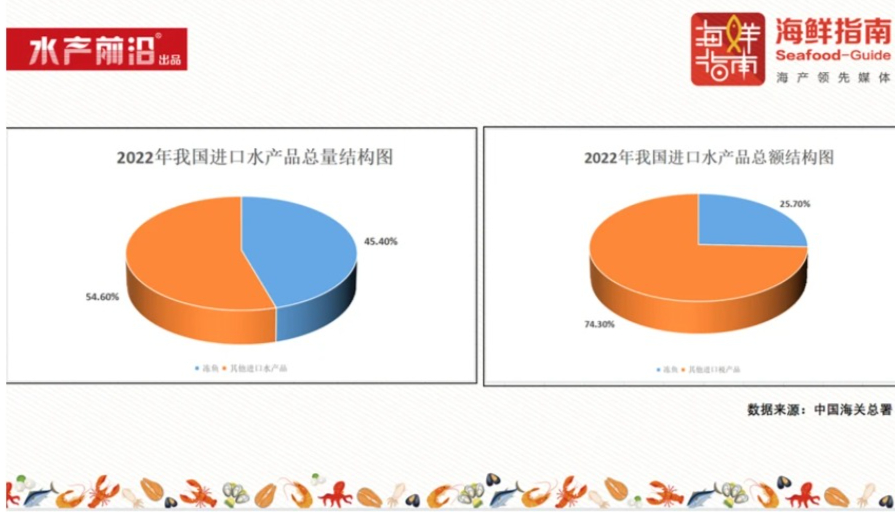

In 2022, China's imported frozen fish will account for 45.4% of the total imports of aquatic products, but from the perspective of total imports, frozen fish will only account for 25.7%. In the future, China's imported frozen fish products still have huge development potential in increasing the added value of products.

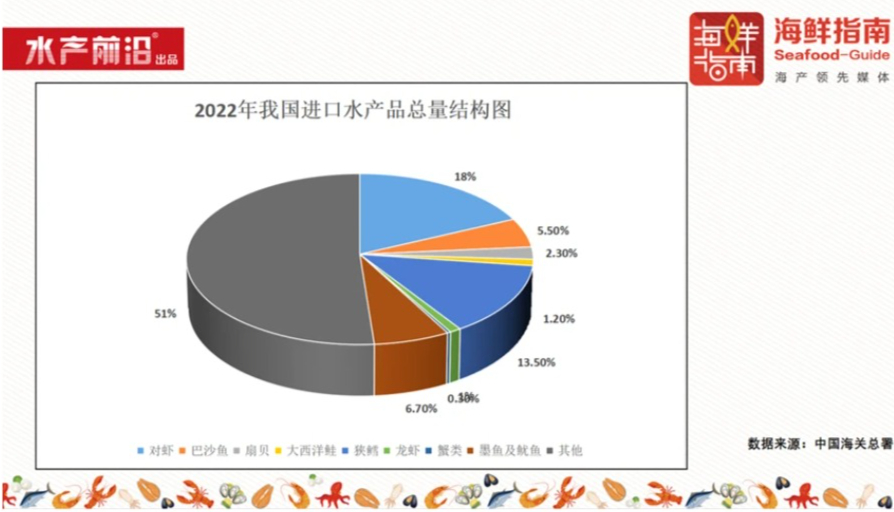

From the perspective of imported aquatic products, prawns, pollock, cuttlefish, squid, pangasius, and salmon are all categories that account for a large proportion of imports, and are also favored by channels such as wholesale markets, catering, supermarkets, and new retail e-commerce. category.

Multi-category imports hit a new high, and the total imports increased faster under the high raw material prices

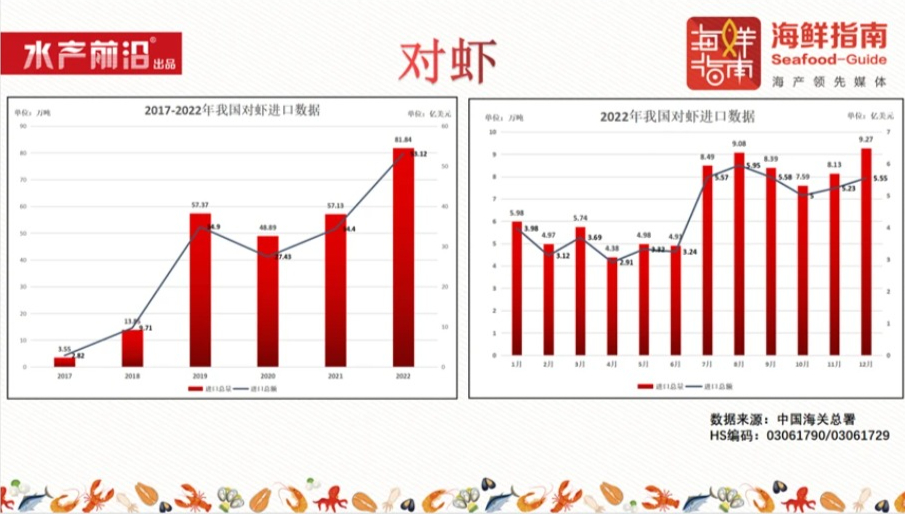

In 2022, China's total import of prawns will reach 818,400 tons, an increase of about 43.2% year-on-year, and the total import value will be US$5.312 billion, an increase of about 54.4% year-on-year. Since July, the total and total amount of China's shrimp imports has remained at a relatively high level. Judging from the data, prawns are one of the categories with better development momentum among all imported aquatic products in 2022.

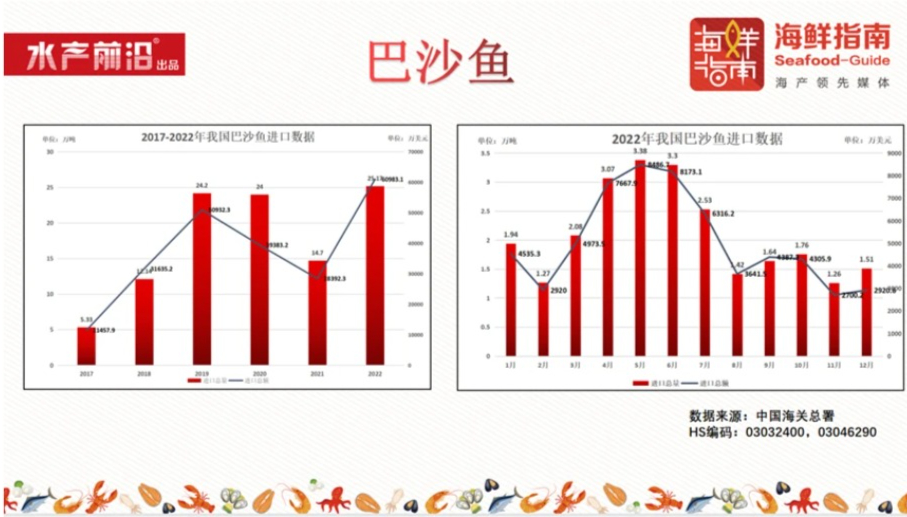

Pangasius also maintains a growth momentum. In 2022, China's total pangasius imports will increase by about 71.2% year-on-year, and the total imports will increase by about 114% year-on-year, both of which are the highest values in the past six years. From the data of the whole year, April to June is the peak of pangasius imports, and the total imports in February and November are relatively low.

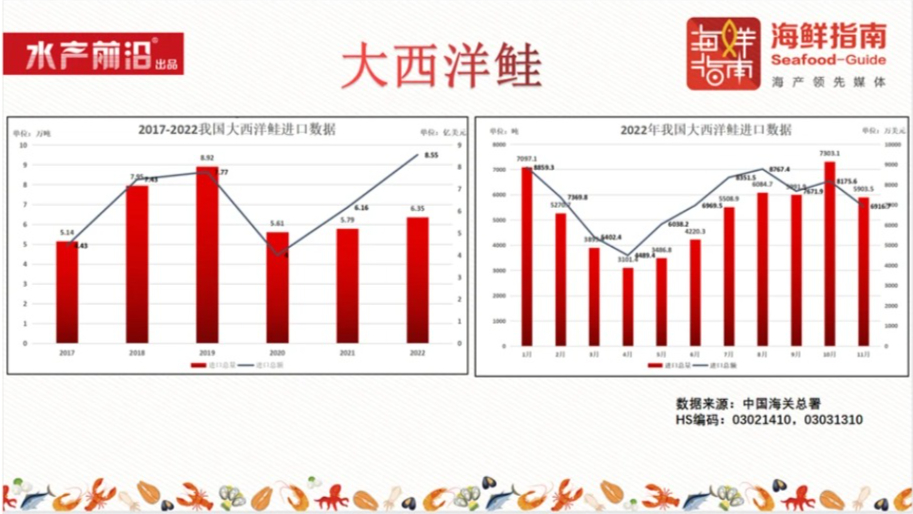

In 2022, the total and total import volume of Atlantic salmon in China will maintain the growth trend since 2020. From the data point of view, in 2022, China's total imports of Atlantic salmon will increase by about 9.6% year-on-year, but the total imports will increase by about 38.8% year-on-year. Atlantic salmon has experienced a more pronounced increase in price due to global feed price increases and inflation.

According to the analysis of imported aquatic products data in 2022, the following trends can be summarized:

1. Under the circumstances of global inflation and rising feed prices, the total amount of imported seafood in China has grown steadily, and the total amount of imports has shown a significant growth trend, and the year-on-year increase has significantly exceeded the increase in import volume. The cost of raw materials for products such as Atlantic salmon, pangasius, pollock, crab, cuttlefish and squid has increased significantly.

2. Affected by the epidemic situation and various factors, the middle of the year (June-September) is the relative peak of the total and total amount of most imported seafood, and the beginning of the year (March-April) and the end of the year (October-December) are relatively low .

3. The total annual import volume of most imported aquatic products is the relative peak value in the past five years, and the total and total import volume of aquatic products will gradually recover after 2020, and the continuous recovery of imported aquatic products in 2023 is expected.

4. Frozen fish accounts for a large proportion (close to 46%) of China's total imported aquatic products, but the proportion of total imports is relatively small. There is still huge room for development in the future to increase the added value of imported frozen fish.

China's aquatic product consumption market is huge, and imported aquatic products are full of development potential and space

The report of the 20th National Congress of the Communist Party of China pointed out: "Establish a big food concept, develop facility agriculture, and build a diversified food supply system." Establishing a big food concept is to start from better meeting the people's needs for a better life and adapt to the changes in the people's food consumption structure , While ensuring food supply, ensure the effective supply of various foods such as meat, vegetables, fruits, and aquatic products.

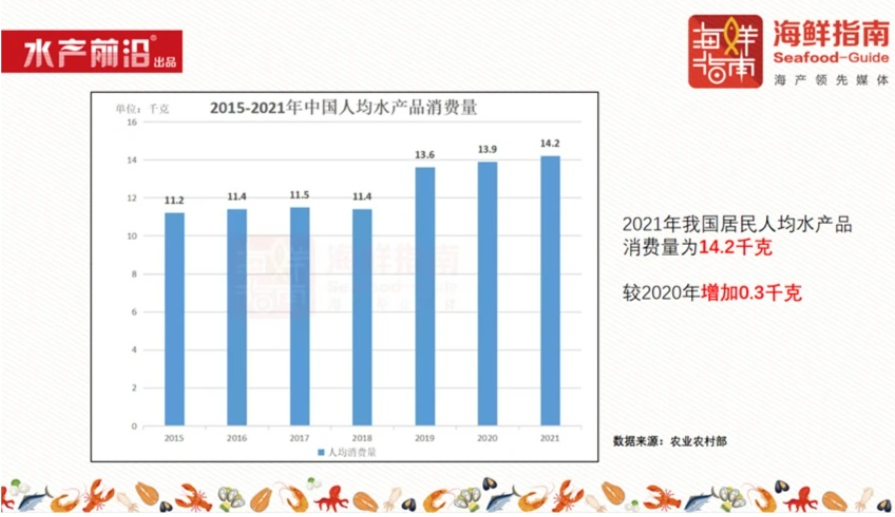

From the perspective of the total consumption of aquatic products in China, the total consumption of aquatic products in 2021 will be about 68.88 million tons, a year-on-year increase of about 2.3%. In 2021, China will import a total of 3.63 million tons of aquatic products, accounting for about 5% of the total annual consumption of aquatic products. In the future, China's imported aquatic products still have broad development potential and space. In addition, the per capita consumption of aquatic products among Chinese residents will be 14.2 kilograms in 2021, a year-on-year increase of 0.3 kilograms.

The judgment of this huge potential is not groundless. In the "Dietary Guidelines for Chinese Residents (2022)" released in 2022, it is recommended that residents eat fish in moderation, preferably 2 times a week or 300~500g. Whether it is guided by policies or dietary guidelines, it shows that the Chinese market has a huge demand for high-quality protein, especially aquatic products.

On the other hand, the consumption of aquatic products through e-commerce channels has increased significantly. In the Double Eleven event in 2022, JD Fresh will open for 4 hours on 11.11. The retail turnover increased by 132% year-on-year, and the 28-hour retail turnover increased by 90% year-on-year.

Source Note: Part of the content of this article is excerpted from the "2022 Annual Report of China's Catering Industry" by China Hotel Association / Liu Shaocong

editorial@seafood.media

www.seafood.media

|