|

Image: Maersk / FIS

Maersk Q1 results in line with expectations amid ongoing Red Sea disruptions

DENMARK

DENMARK

Friday, May 03, 2024, 07:00 (GMT + 9)

AP Moller - Maersk (Maersk) delivered a first quarter in line with expectations showing a strong recovery in earnings compared to the fourth quarter of 2023. Results were driven by a good performance in Terminals and the combination of higher demand and a prolonged Red Sea crisis. As these conditions are expected to continue well into the second half of the year, Maersk lifts the lower end of its guidance range and now expects underlying EBIT at USD -2.0 to 0.0bn.

Source: Maersk

"We had a positive start to the year with a first quarter developing precisely as we expected. Demand is trending towards the higher end of our market growth guidance and conditions in the Red Sea remain entrenched. This not only supported a recovery in the first quarter compared to the previous quarter, but also provide an improved outlook for the coming quarters, as we now expect these conditions to stay with us for most of the year."

.png) "However, we still anticipate the high number of new vessels being delivered during this and next year to eventually offset these factors and put the ocean markets under renewed pressure. We therefore relentlessly continue to pursue our cost agenda with the aim of rolling back the disruption linked cost in Ocean and restoring margins in Logistics & Services. This work on cost, helped by our strong value proposition, is crucial in supporting our customers through the ongoing volatility and build a more resilient business," says Vincent Clerc, CEO of Maersk. "However, we still anticipate the high number of new vessels being delivered during this and next year to eventually offset these factors and put the ocean markets under renewed pressure. We therefore relentlessly continue to pursue our cost agenda with the aim of rolling back the disruption linked cost in Ocean and restoring margins in Logistics & Services. This work on cost, helped by our strong value proposition, is crucial in supporting our customers through the ongoing volatility and build a more resilient business," says Vincent Clerc, CEO of Maersk.

- Ocean results were impacted by the situation in the Red Sea with increased market rates and costs due to the supply chain disruptions. Strong volumes, high capacity utilisation and continued cost discipline ensured improved results compared to the previous quarter.

- Logistics & Services saw significant growth in volumes, while margin was at an unsatisfactory level on the back of too low utilization in some of our warehouses and short-term challenges implementing new customer contracts in the ground freight business in North America.

- Terminals started the year with strong results supported by good volumes growth. Strong cost management and high productivity helped improve margins.

Maersk continued to streamline its portfolio to focus on end-to-end logistics with the spin-off of Svitzer. The demerger was approved by an Extraordinary General Meeting on April 26th and completed on April 30th, with Svitzer Group A/S now listed on the Nasdaq Copenhagen.

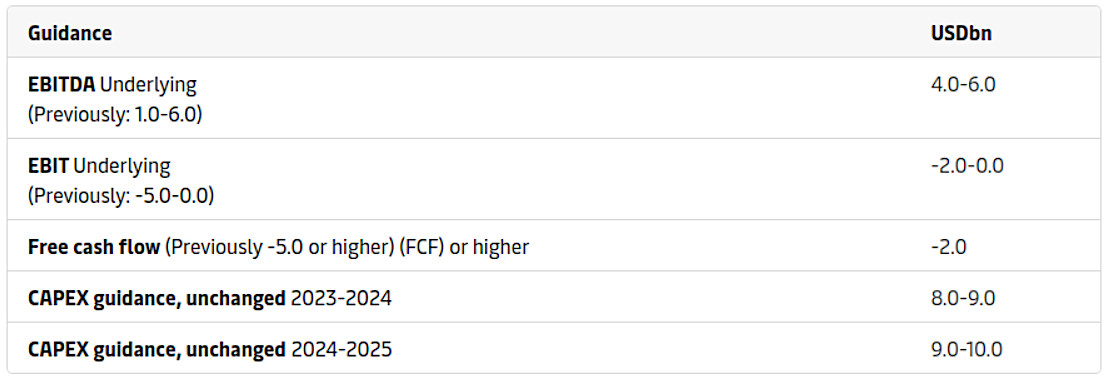

Financial guidance for 2024

The lower end of the original financial guidance is raised based on a strong market demand with container volume growth towards the upper end of the 2.5-4.5% range and A.P. Moller - Maersk growing in line with the market. Further, the ongoing Red Sea / Gulf of Aden situation is expected to continue into the second half of the year. Over-supply remains a challenge and will eventually prevail, but the impact is delayed.

For the full-year 2024, A.P. Moller - Maersk raises its financial guidance as seen in the table below.

Source: Maersk

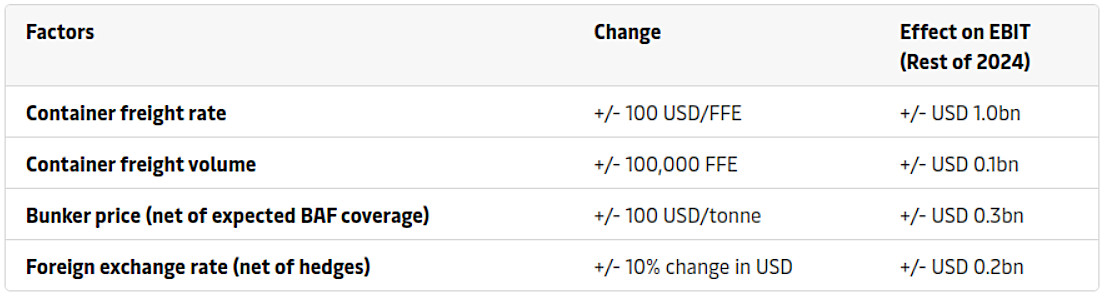

Sensitivity guidance

Financial performance for A.P. Moller - Maersk for 2024 depends on several factors subject to uncertainities related to the given the uncertain macroeconomic conditions, bunker fuel prices and freight rates. All else being equal, the sensitivities for 2024 for four key assumptions are listed below:

Source: Maersk

Cash distribution to shareholders

A total distribution of cash to shareholders of USD 1.5bn took place during Q1 2024 through dividends paid of USD 1.0bn and share buy-backs of USD 443m.

Source: Maersk

editorial@seafood.media

www.seafood.media

|