|

Photo: Vasep/FIS

Who are Vietnamese pangasius competing with to gain market share?

VIET NAM

VIET NAM

Tuesday, August 13, 2024, 00:10 (GMT + 9)

Whitefish is always a favorite fish of consumers in many countries because of its delicious taste and nutrition. Vietnamese pangasius is exported to nearly 140 countries around the world, being one of them. However, pangasius is facing increasingly fierce competition in the international market, not only with other white fish species, but also with market challenges and barriers.

The Chinese, US, EU, and CPTPP markets are the largest destinations for Vietnamese pangasius. These markets also consume other white-flesh fish species, which are “heavyweight” competitors of Vietnamese pangasius.

Heavyweight competitors of Vietnamese pangasius

Cod is considered the "king" of fish, cod has high brand value, good meat quality, abundant nutritional value, rich in protein, vitamins and minerals, meeting high nutritional needs, so this is a species with a high position in the cuisine of many countries. However, high prices due to seasonality and limited supply are major barriers.

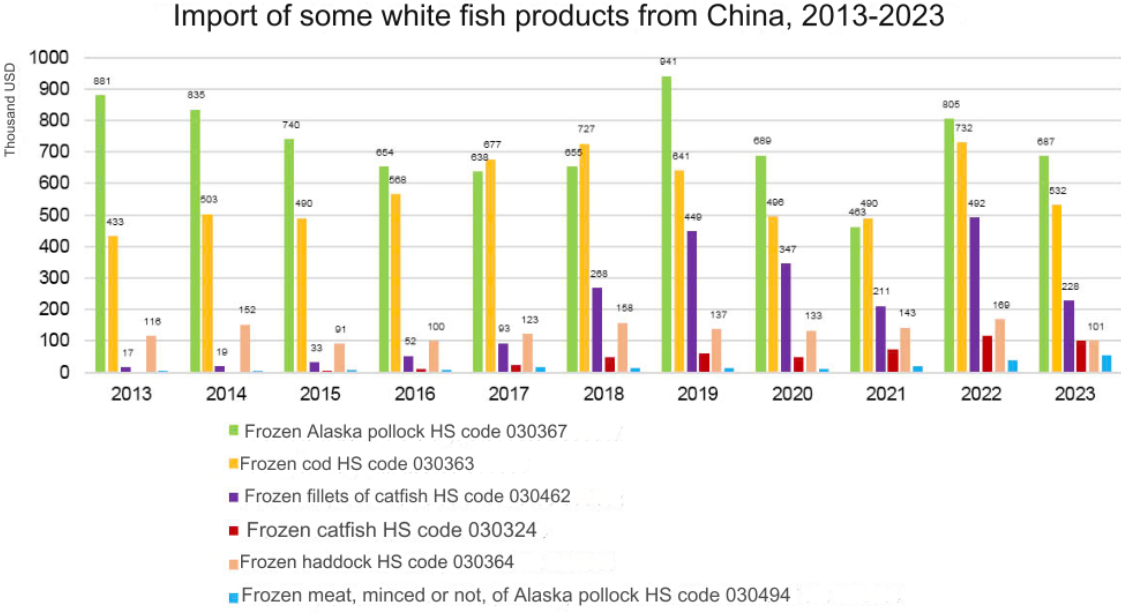

According to data from the International Trade Center (ITC), in the first half of this year, China's imports of frozen cod with HS code 030363 from the world reached nearly 296 million USD, down 10% compared to the same period in 2023. 2022 was the year this country imported the most frozen fish, with more than 732 million USD, up 49% compared to 2021.

Second in popularity in China after pollock, cod is the most consumed whitefish in the US, especially frozen cod fillets with HS code 030471. In 2023, imports of this product into the US reached 475 million USD, down 22% over the same period, accounting for 27% of the total whitefish imported by the US from the world. Previously, in 2022, this country consumed nearly 610 million USD of cod fillets, up 47% over 2021, and was the year with the most imports of this product to date.

Pollock is a good alternative to cod with a sweet taste, less fat and more affordable and stable prices than other fish species. However, hake is less diverse in products and is often used to process basic products such as fish balls and fish fillets. According to ITC, in the first half of this year, China's imports of frozen Alaska pollock with HS code 030367 reached more than 353 million USD, down 23% compared to the same period in 2023. Up to now, 2019 is recorded as the year China consumed the most of this product, with nearly 941 million USD, up 44% over the same period.

Tilapia is also rich in protein and essential amino acids, and the price of tilapia is often quite competitive in the market. Tilapia, especially frozen tilapia fillets, is a favorite product in the US, second only to cod fillets. According to ITC, in 2023, the US imported 372 million USD of this product, down 28% compared to 2022.

Basa fish has many similarities with tra fish, but basa fish is usually larger in size and has thicker meat. However, the meat quality of basa fish is uneven and the brand has not been built as strongly as tra fish.

What does pangasius have to compete with other white-fleshed fish?

As one of the largest farmed fish in the world, Vietnamese pangasius has its own distinct advantages: Competitive price: Vietnamese pangasius is often priced lower than other white-fleshed fish, helping to attract many customers, especially in emerging markets; Large, stable output: Vietnam is one of the largest pangasius producing countries in the world, ensuring a stable supply for the market; Product diversity: Pangasius is processed into many different products, meeting the needs of many customers; Favorable geographical location: Vietnam has a favorable geographical location, helping to reduce transportation costs and shorten delivery times.

However, the quality of pangasius products is still uneven, depending on many factors such as breed, feed, farming environment; Facing many trade barriers such as import taxes, technical regulations, etc.; Unfair competition activities such as dumping and trade fraud can affect the reputation of Vietnamese pangasius in the international market; The change in market policies while the cost of pangasius production is increasing due to increased input material prices and labor costs, also affects pangasius exports. However, the quality of pangasius products is still uneven, depending on many factors such as breed, feed, farming environment; Facing many trade barriers such as import taxes, technical regulations, etc.; Unfair competition activities such as dumping and trade fraud can affect the reputation of Vietnamese pangasius in the international market; The change in market policies while the cost of pangasius production is increasing due to increased input material prices and labor costs, also affects pangasius exports.

In addition, Vietnamese pangasius also faces competition from other catfish producing countries such as India, Bangladesh, and Indonesia. These countries all have advantages in raw materials and production costs, creating significant pressure on the Vietnamese pangasius industry.

According to ITC, Vietnam is the second largest supplier in the race to export whitefish to China, after Russia. In the first half of this year, China imported nearly 80,000 tons of whitefish (mainly pangasius) from Vietnam, down 17% over the same period in 2023. Meanwhile, imports from the US reached 45,000 tons, up 57%; Norway reached 19,000 tons, up 28%; from Greenland reached nearly 5,000 tons, up 188%; from the Netherlands reached more than 5 million USD, up 179%; from Korea reached more than 2 million USD, up 237%,...

According to ITC, Vietnam is also the second largest supplier of whitefish (mainly pangasius) to the US, after China. In the first 5 months of this year, the US imported more than 45 thousand tons of whitefish (mainly pangasius) from Vietnam, an increase of 37%, accounting for 30% of the total US whitefish imports from the world.

Each type of fish has its own advantages and disadvantages. Vietnamese pangasius has advantages in terms of price and output, but it needs to improve quality, build a brand and diversify products to compete more effectively. To overcome competitors, Vietnamese pangasius needs to focus on improving product quality: Ensuring food safety and hygiene, applying international standards; Building a brand: Creating a positive image for Vietnamese pangasius in the international market; Diversifying markets: Finding new markets, especially high-end markets; Developing value-added products: Processing pangasius into products of higher value; Investing in technology: Applying modern technology to the production, processing and preservation of pangasius; Sustainable development: Focusing on sustainable development, protecting the environment and ensuring workers' welfare.

Vietnamese pangasius has great potential to compete in the international market. However, to be successful, the pangasius industry needs to proactively "deepen" the market, improve product quality and build brands, and diversify markets.

According to Vietnam Customs, in the first half of July 2024, Vietnamese pangasius exports reached 85 million USD, up 22% over the same period in 2023. Cumulative exports up to July 15, 2024 reached more than 1 billion USD, up 6% over the same period last year.

(7)(1).png)

Author/Source: Thu Hằng/Vietnam Association of Seafood Exporters and Producers (VASEP)

editorial@seafood.media

www.seafood.media

|

|