|

Photo: Norwegian Seafood Council/FIS

Market situation for Norwegian shellfish (king crab, snow crab, coldwater prawn)

NORWAY

NORWAY

Monday, September 09, 2024, 00:10 (GMT + 9)

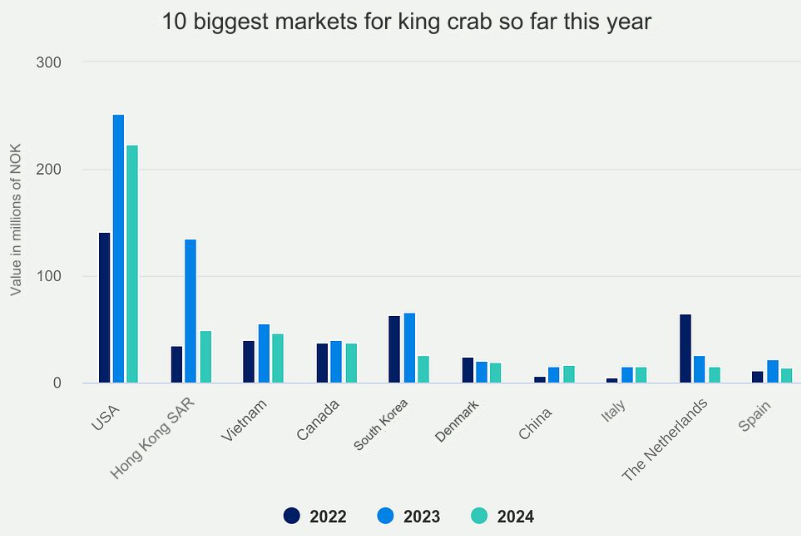

Reduction in quotas leads to continued decline for king crab

- Norway exported 223 tonnes of king crab worth NOK 105 million in August

- The value fell by NOK 79 million, or 43 per cent, compared with the same month last year

- Volume fell by 44 per cent

- The US, Hong Kong SAR and Vietnam were the largest markets for king crab in August

August is usually one of the strongest months for king crab catches and exports, with high demand for live king crab in Asia. This year, the quota reduction has led to a decline in landings and exports compared with August last year.

Clici on the image to enlarge

In August, live king crab accounted for 86 per cent of the export volume. The Asian markets dominate here, with a share of 71 per cent of the export volume. This is despite increased competition from Russia in the Asian market. Russia began fishing for red king crab earlier this year.

The export price is only just above last year's August with an average price of NOK 469 per kg, continuing a downward trend from the start of the year.

"The decline in export prices should be seen in the context of increased competition from Russia and the fact that smaller king crabs have been landed and exported," says Josefine Voraa, Head of Shellfish at the Norwegian Seafood Council. "The decline in export prices should be seen in the context of increased competition from Russia and the fact that smaller king crabs have been landed and exported," says Josefine Voraa, Head of Shellfish at the Norwegian Seafood Council.

It was a weak export month for frozen king crab, with a decline in volume of 78 tonnes. The biggest decline is to the US market, which is down 52 tonnes so far this year.

"We recognise that higher demand for live king crab and lower availability of large crab are some of the reasons for the fall in frozen king crab prices in August this year," explains Josefine Voraa.

Japan is the largest market for snow crab

- Norway exported 49 tonnes of snow crab worth NOK 7 million in August

- The value increased by NOK 4 million, or 143 per cent, compared to the same month last year

- This is a growth in volume of 51 per cent

- Japan, USA and Belgium were the largest markets for snow crab in August

"With a record-breaking peak in catches and a record-high volume exported during the first half of the year, it is not unexpected that less volume is now being exported," says Josefine Voraa.

.png)

Clici on the image to enlarge

In August, Japan was the largest market for frozen snow crab, continuing the positive trend of increased volumes that we have seen so far this year. Up to and including August, almost 900 tonnes have been exported, which is 144 per cent above last year in volume.

"Demand for frozen snow crab in the Japanese market has picked up this year in line with the growth and development of the country's economy," explains Voraa.

.png)

Clici on the image to enlarge

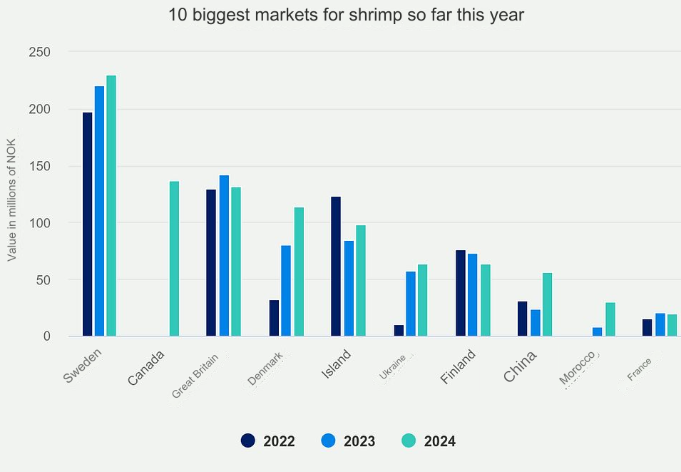

Challenging situation in Canada fuels growth in prawn exports

- Norway exported 3,440 tonnes of prawn to a value of NOK 154 million in August

- The value increased by NOK 36 million, or 31 per cent, compared with the same month last year

- This is a growth in volume of 109 per cent

"The prawn fishery in the Barents Sea is still good, with many boats in the field and increased landings of industrial prawn and frozen, cooked shellfish. This has led to a strong volume increase in prawn exports in August this year compared to last year," says Josefine Voraa, Head of Shellfish.

Clici on the image to enlarge

The growth in value in August is mainly due to increased volumes of raw frozen industrial prawn. More than 1,700 tonnes of industrial prawn went to the industry in Iceland and Canada in August, compared with nothing last year.

Canada faces major challenges in its fishery with declining quotas and catches of cold-water prawn, which has resulted in 5,520 tonnes of industrial prawn going there so far this year.

Source: Norwegian Seafood Council

editorial@seafood.media

www.seafood.media

|