|

Photo: Norwegian Seafood Council/FIS

Market situation for norwegian cod (farmed, fresh, frozen, salted, clipfish)

NORWAY

NORWAY

Monday, September 09, 2024, 00:10 (GMT + 9)

Increase in farmed cod and continued reduction in fresh wild cod

- Norway exported 2,341 tonnes of fresh cod worth NOK 143 million in August

- The value increased by NOK 7 million, or 5 per cent, compared with the same month last year

- The volume was unchanged from August last year

- Denmark, the Netherlands and Latvia were the largest markets for fresh cod in August

For fresh wild cod, the export volume fell by 18 per cent to 1,574 tonnes, while the export value fell by 12 per cent to NOK 97 million. Both the export volume and export value of fresh wild cod have now fallen for 11 consecutive months, and as in previous months, the decline in the cod quota is the main reason.

.png)

Click on the imagen to enlarge

For fresh farmed cod, the export volume increased by 84 per cent to 767 tonnes, while the export value increased by 72 per cent to NOK 47 million. So far this year, 8,100 tonnes of fresh farmed cod have been exported, which is 41 per cent higher than last year. Farmed cod accounted for 33 per cent of the export value of fresh cod in August.

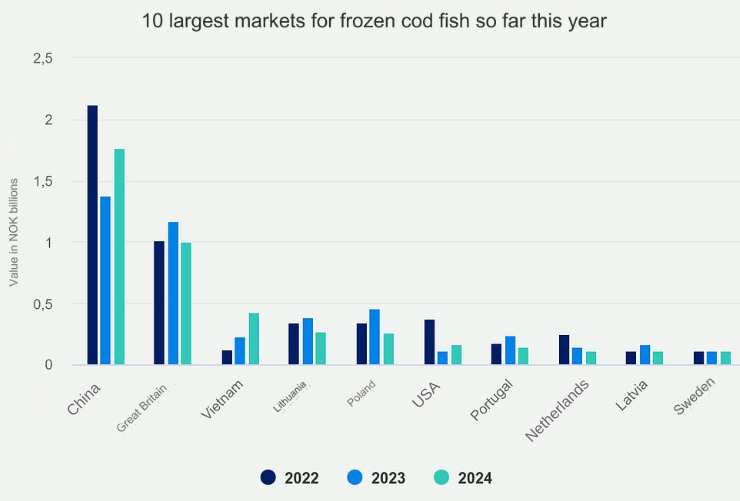

Frozen cod increases in China after import ban

- Norway exported 2,706 tonnes of frozen cod worth NOK 194 million in August

- The value fell by NOK 13 million, or 6 per cent, compared with the same month last year.

- Volume fell by 24 per cent

- China, the UK and Latvia were the largest markets for frozen cod in August

China saw the greatest growth in value in August, with an increase in export value of NOK 42 million, or 248 per cent, compared with the same month last year. The export volume to China ended at 884 tonnes, which is 109 per cent higher than the same month last year.

Click on the imagen to enlarge

"After the US import ban on Russian cod was tightened to include cod processed in third countries, the Chinese processing industry has had to find other suppliers for cod destined for the US market," explains Eivind Hestvik Brækkan, Seafood Analyst at the Norwegian Seafood Council.

.jpg) "Although export volumes from Norway to China are still far lower than they were two years ago, volumes to China have increased sharply in recent months. "We believe a large proportion of this cod will be processed and re-exported to the USA," continues Brækkan. "Although export volumes from Norway to China are still far lower than they were two years ago, volumes to China have increased sharply in recent months. "We believe a large proportion of this cod will be processed and re-exported to the USA," continues Brækkan.

Fewer large cod affect clipfish consumption

- Norway exported 6,592 tonnes of clipfish worth NOK 429 million in August

- The value fell by NOK 63 million, or 13 per cent, compared with the same month last year.

- Volume fell by 13 per cent

- Portugal, the Dominican Republic and Brazil were the largest markets for clipfish in August

For saithe clipfish, the export volume fell by 11 per cent to 4,314 tonnes, while the export value fell by 17 per cent to NOK 180 million. Although the export price for saithe clipfish increased slightly from July to August, it remains well below last year's price, with a price of NOK 42 in August, down from NOK 45 in the same month last year.

For cod clipfish, the export volume fell by 13 per cent to 1,635 tonnes, while the export value fell by 7 per cent to NOK 209 million. Lower availability of large cod means that small clipfish takes a larger share.

.png)

Click on the imagen to enlarge

Small clipfish on the rise in Portugal

Reduced availability of large cod is also affecting consumption in our largest clipfish market, Portugal. Consumption of Crescido, which is small clipfish, has increased significantly this year, while consumption of larger clipfish such as Graudo and Especial has decreased.

.png) “Lower cod quotas also mean that the export volume of clipfish is falling. The fact that there are fewer large cod available is a challenge for producers and consumers, who prefer the largest clipfish. So it's positive to see that the Portuguese are adapting to the smaller sizes available and continuing to eat Norwegian clipfish," says Trond Rismo, the Norwegian Seafood Council's envoy to Portugal. “Lower cod quotas also mean that the export volume of clipfish is falling. The fact that there are fewer large cod available is a challenge for producers and consumers, who prefer the largest clipfish. So it's positive to see that the Portuguese are adapting to the smaller sizes available and continuing to eat Norwegian clipfish," says Trond Rismo, the Norwegian Seafood Council's envoy to Portugal.

“Grocery prices for clipfish in Portugal have followed roughly the same trend as food in general over the past two years. Recently, however, we have seen a noticeable increase in clipfish prices in Portugal, especially for large clipfish," explains Trond Rismo.

Saithe clipfish adds value to the Dominican Republic

For saithe clipfish, the Dominican Republic is our largest market. This is also the market with the highest value growth in August, with an increase in export value of NOK 13 million, or 23 per cent, compared with the same month last year.

The export volume to the Dominican Republic ended at 1,800 tonnes, which is 28 per cent higher than the same month last year. 98 per cent of the export volume to the Dominican Republic is saithe clipfish.

Both volume and value of salted fish fall

Norway exported 917 tonnes of salted fish worth NOK 69 million in August Norway exported 917 tonnes of salted fish worth NOK 69 million in August- The value fell by NOK 7 million, or 9 per cent, compared with the same month last year

- Volume fell by 11 per cent

- Portugal, Italy and France were the largest markets for salted fish in August

Salted whole cod accounted for 53 per cent of the export volume of salted fish in August, and all exports of salted whole cod went to Portugal. Portugal was also the market with the highest value growth in August, with an increase in export value of NOK 5 million, or 9 per cent, compared with the same month last year. The export volume to Portugal ended at 611 tonnes, which is 15 per cent higher than the same month last year.

Strong value growth for stockfish

- Norway exported 221 tonnes of stockfish worth NOK 48 million in August

- The value increased by NOK 27 million, or 137 per cent, compared with the same month last year

- Volume fell by 2 per cent

- Italy, USA and Canada were the largest markets for stockfish in August

"The reason why the export value increased by more than 100 per cent at the same time as the volume fell is that cod stockfish accounted for only 25 per cent of the stockfish volume in August last year, while this year it accounted for more than 60 per cent," explains Eivind Hestvik Brækkan.

“Since stockfish of cod has a much higher price than stockfish of other species, there was a strong increase in value even though the total export volume of stockfish fell," says Brækkan.

Italy, Norway's largest stockfish market, saw the greatest growth in value in August, with an increase in export value of NOK 24 million compared with the same month last year. The export volume to Italy ended at 81 tonnes, which is 74 tonnes higher than the same month last year.

editorial@seafood.media

www.seafood.media

|