|

Photo: Wärtsilä

Wärtsilä’s Interim Report January–September 2024

(FINLAND, 10/31/2024)

(FINLAND, 10/31/2024)

IMPROVED NET SALES, PROFITABILITY AND CASH FLOW

WÄRTSILÄ'S PROSPECTS

Marine

Wärtsilä expects the demand environment for the next 12 months (Q4/2024-Q3/2025) to be better than that of the comparison period.

Energy

Wärtsilä expects the demand environment for the next 12 months (Q4/2024-Q3/2025) to be better than that of the comparison period.

HÅKAN AGNEVALL, PRESIDENT & CEO: SUSTAINED POSITIVE MOMENTUM

“The market environment for Wärtsilä’s businesses remained stable during the third quarter of 2024. However, geopolitical risks have amplified in recent months, adding uncertainty to the macroeconomic outlook.

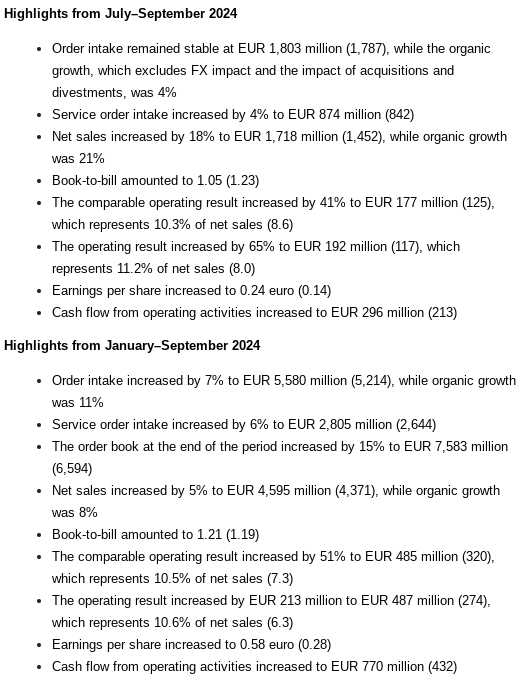

The energy market continued to be influenced by protectionism and elevated geopolitical risks. Despite the uncertainty surrounding the pace of the global energy transition, renewable energy sources have remained dominant in new capacity additions. The increasing need for balancing power to support the growth in renewable energy deployments has resulted in improved demand for engine power plants compared to last year. The grid balancing capabilities of Wärtsilä’s engines ensure that customers can maintain a consistent and reliable energy supply while progressing towards decarbonisation. Notably, in .png) September, Wärtsilä announced being contracted to deliver four Wärtsilä 50SG engines to a new power plant for the Kentucky Municipal Energy Agency (KYMEA). The fast-starting engines will offer flexibility and a rapid response to fluctuations in the availability of wind and solar power, thereby protecting KYMEA’s members from electricity market price volatility. September, Wärtsilä announced being contracted to deliver four Wärtsilä 50SG engines to a new power plant for the Kentucky Municipal Energy Agency (KYMEA). The fast-starting engines will offer flexibility and a rapid response to fluctuations in the availability of wind and solar power, thereby protecting KYMEA’s members from electricity market price volatility.

In the marine market, geopolitical conflicts continued to affect trade flows around the globe. Sanctions on Russia and attacks on ships in the Red Sea have resulted in longer average shipping distances, higher transportation costs, and delays to global supply chains, driving the need for additional ship capacity. Despite growth in shipyard capacity and output, especially in China but also in South Korea, newbuild shipyard capacity utilisation remains high, indicating that a shortage of yard capacity still exists. The market sentiment for Wärtsilä was positive, with robust momentum in key customer segments for new vessels, while decarbonisation-related retrofits and longer trade routes supported the demand for services. Investments in new ships increased compared to last year with a positive trend in the interest for alternative fuels. In addition to LNG and methanol, ammonia has emerged as a promising alternative fuel as the shipping industry looks for more sustainable options. In August, Wärtsilä announced a landmark deal with Eidesvik to supply the equipment for the conversion of an offshore platform supply vessel to operate with ammonia fuel. The vessel, ‘Viking Energy’, is set to become the world's first ammonia-fuelled in-service ship in 2026.

Photo: Wärtsilä energy

Another highlight of the quarter was the signing of a five-year Lifecycle Agreement with Royal Caribbean Group covering 37 cruise ships. Reaching the industry’s goal of net-zero operations requires installing the right technical solutions onboard, but it is also crucial to ensure these solutions perform optimally throughout their entire lifetime. Wärtsilä’s Lifecycle Agreements provide this assurance and highlight the importance of collaboration in addressing the industry’s goals.

Wärtsilä’s order intake in the third quarter increased organically by 4%. Service order intake increased driven by good activity levels in Marine. Equipment order intake decreased slightly overall but grew clearly in Engine Power Plants. Equipment orders were lower in Marine, due to a strong comparison period, as well as in Energy Storage & Optimisation where some project closings were deferred to later quarters. The average size of projects in Energy Storage & Optimisation has increased, which has contributed to the lumpiness of the business. Overall, we continue to see growing demand for Energy Storage & Optimisation solutions.

Net sales in the third quarter increased organically by 21%, with growth in both equipment and service. As we have previously communicated, equipment deliveries especially in Energy are tilted towards the second half of the year in 2024. This had a positive impact on equipment net sales in the third quarter. In Marine, the lead times from equipment order intake to net sales are slightly longer, due to the remaining constraints in shipyard capacity and longer shipyard orderbooks.

Photo: Wärtsilä energy

The comparable operating result increased by 41% to EUR 177 million with a comparable operating margin of 10.3%. The comparable operating result increased in all three businesses. During recent years, Wärtsilä’s comparable operating margin percentage has typically reached its high in the fourth quarter of each year. In 2024, we do not expect to see that normal seasonality, given the mix impact from increasing equipment deliveries. However, this is dependent on the volume of equipment deliveries that will be realised in the fourth quarter.

Cash flow from operating activities ended strong and significantly improved to EUR 296 million during the third quarter. The improvement in cash flow was driven mainly by a better operating result. It is important to note that the current negative working capital levels are unusual for our business, and we expect them to normalise going forward. Still, our active work on all elements of working capital has continued and has supported us in keeping working capital at a clearly lower level than the long-term historical average.

In October 2023, we announced a strategic review of Energy Storage & Optimisation to accelerate its profitable growth in a way that benefits customers, employees, and value creation for Wärtsilä shareholders. This review is still ongoing.

Photo: Wärtsilä Marine

We remain optimistic about growth prospects in both of our markets. We expect the demand environment for the coming 12 months to be better than for the comparison period in both Marine and Energy.

Employees are the key to our success. Our recent engagement survey achieved an impressive 88% response rate, and Wärtsilä received excellent ratings in leadership, inclusion, wellbeing, and intent to stay, reflecting a high level of commitment from our people. By relentlessly executing our strategy together, we are adding value to our customers, making a significant impact in our industries, and steadily progressing towards our financial targets.”

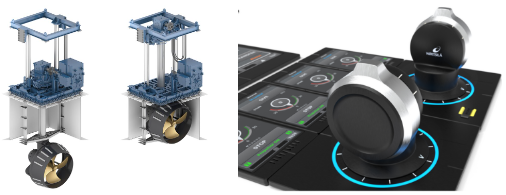

KEY FIGURES

Click on the image to enlarge

Wärtsilä presents certain alternative performance measures in accordance with the guidance issued by the European Securities and Markets Authority (ESMA). The definitions of these alternative performance measures are presented in the Calculations of financial ratios section.

editorial@seafood.media

www.seafood.media

Information of the company:

|

Address:

|

John Stenbergin ranta 2 - P.O. Box 196

|

|

City:

|

Helsinki

|

|

State/ZIP:

|

(FI-00531)

|

|

Country:

|

Finland

|

|

Phone:

|

+358 10 709 0000

|

|

Fax:

|

+358 10 709 5700

|

|

E-Mail:

|

contact@wartsila.com

|

More about:

|

|

|

|